Janie Sanchez

Hi there, I’m Janie, a design strategist turning complexity into clarity for people, teams, and futures.

Currently designing at Vanguard to help make financial goals feel actionable.

Wondering about the red underline? Ask me about it in computer class.

reach out: hello@janiesanchez.com

The ChallengeThe rise of mainstream Generative AI in 2023 marked an inflection point, reshaping competitive capabilities and redefining user expectations.

My RoleAs a designer and strategist, I helped define the full potential of this capability as a way to close current user gaps and future-proof our offering.

To scale toward this vision, I outlined clear, actionable paths that bridged near-term feasibility with long-term ambition.

Gap focus 1:

Human Connections

Exploring GenAI started with a core truth: Relationships matter at Vanguard, but there are gaps in how human connection takes place.

Key satisfaction gaps

- Our research at Vanguard found that client satisfaction with personal advice varied widely.

- My synthesis connected gaps that GenAI could help fill in existing relationships, and that we could also scale to self-directed investors that don’t yet have a personal advisor via an experience that is:

- Personalized + knowledgable

- Available + collaborative

- Proactive + connected

Happy

- Connection feels deeply human and personalized

- Advisor is proactive, prepared, and shares important knowledge

- Expectations are set and met without surprises

Eh

- Spotty availability

- Inconsistent or impersonal connection

Frustrated

- Surface-level connection

- Unavailable advisor or unapproachable

- Interruptions due to advisor turnover

Gap focus 2:

Wayfinding

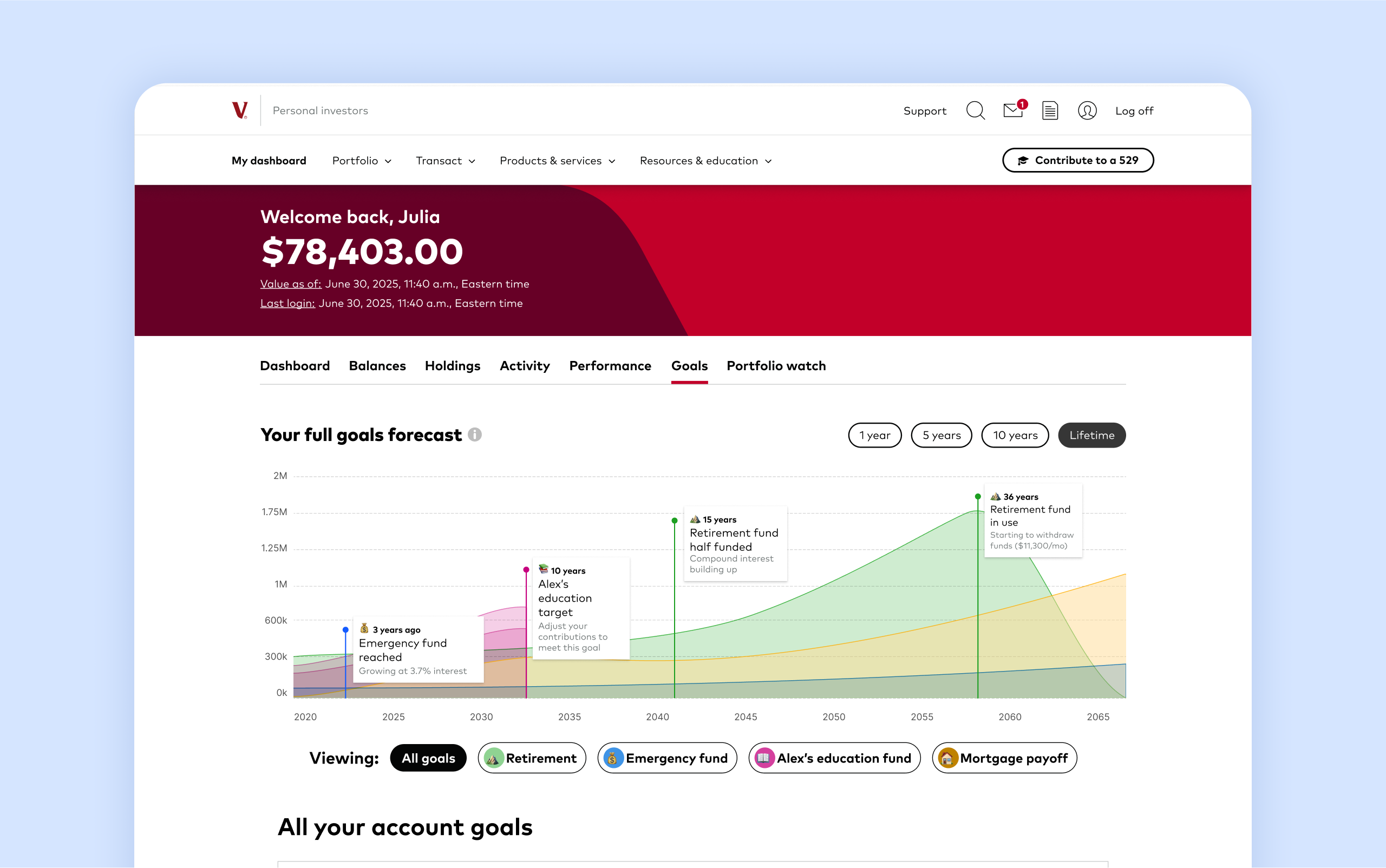

Pain points in wayfinding and navigation account for 18% of all user survey comments across digital channels.

Solving for use cases

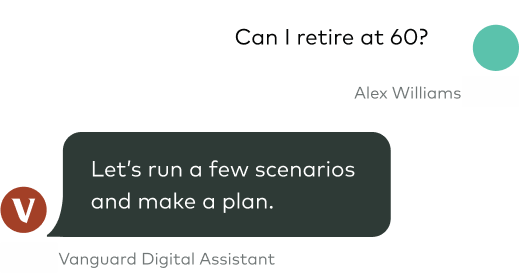

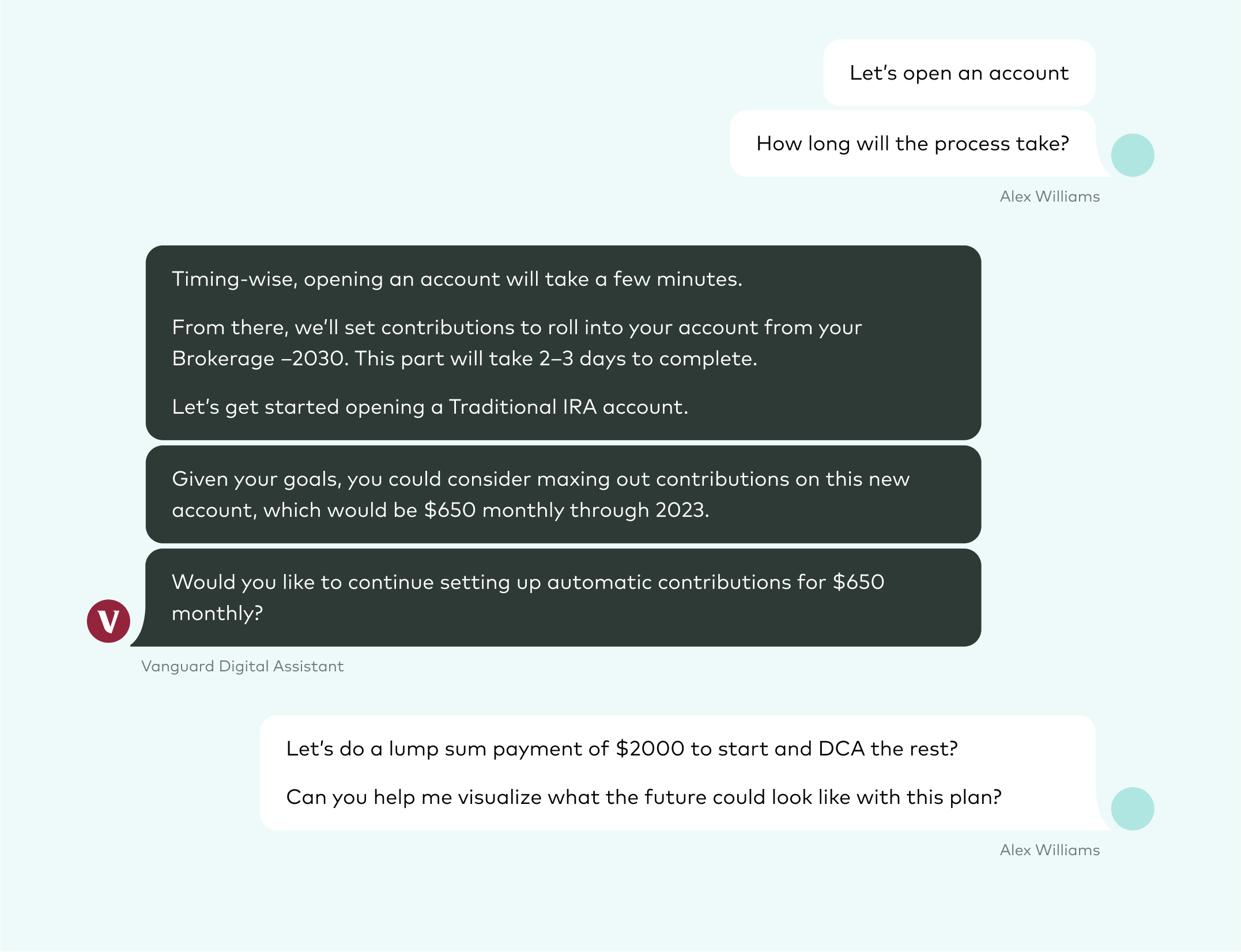

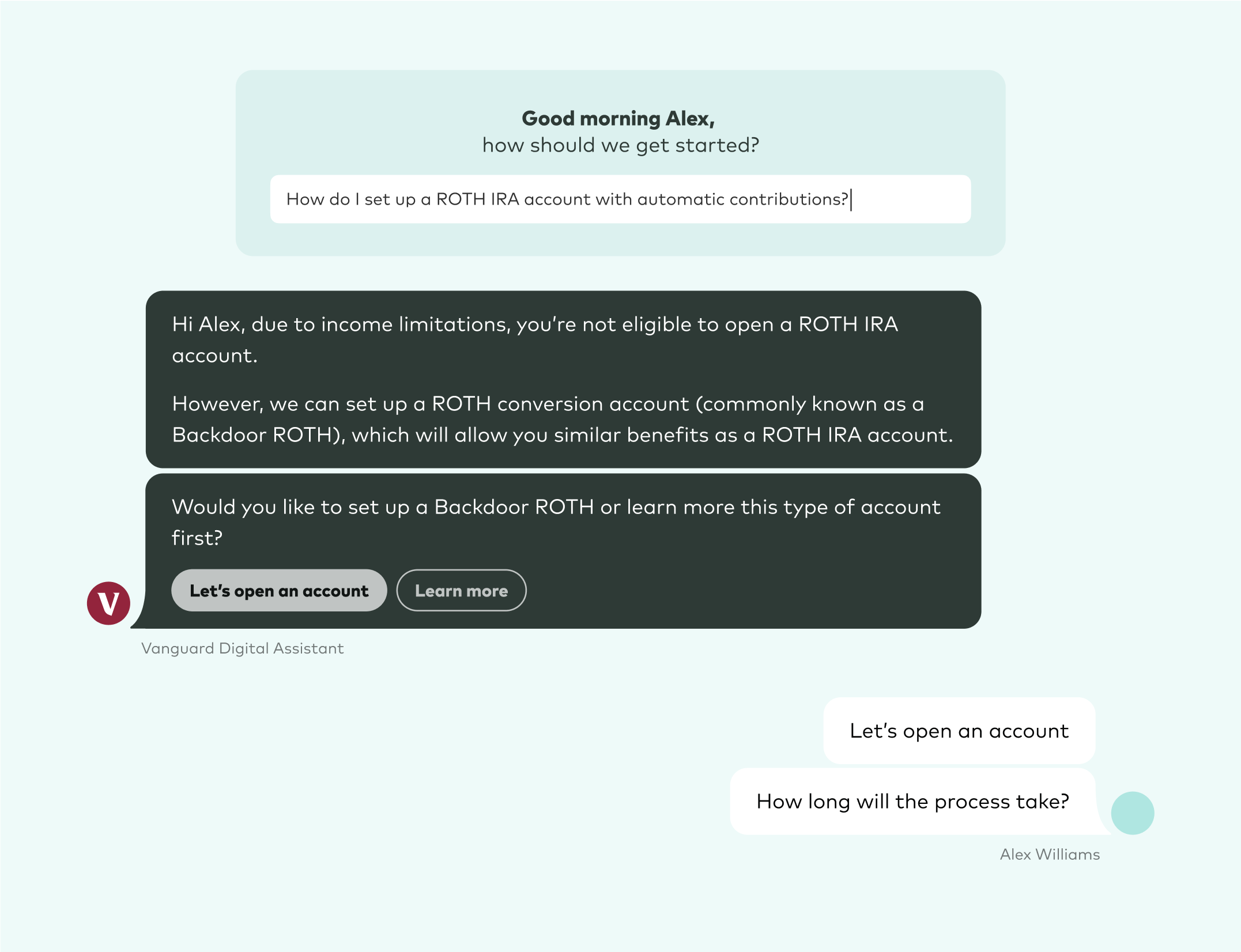

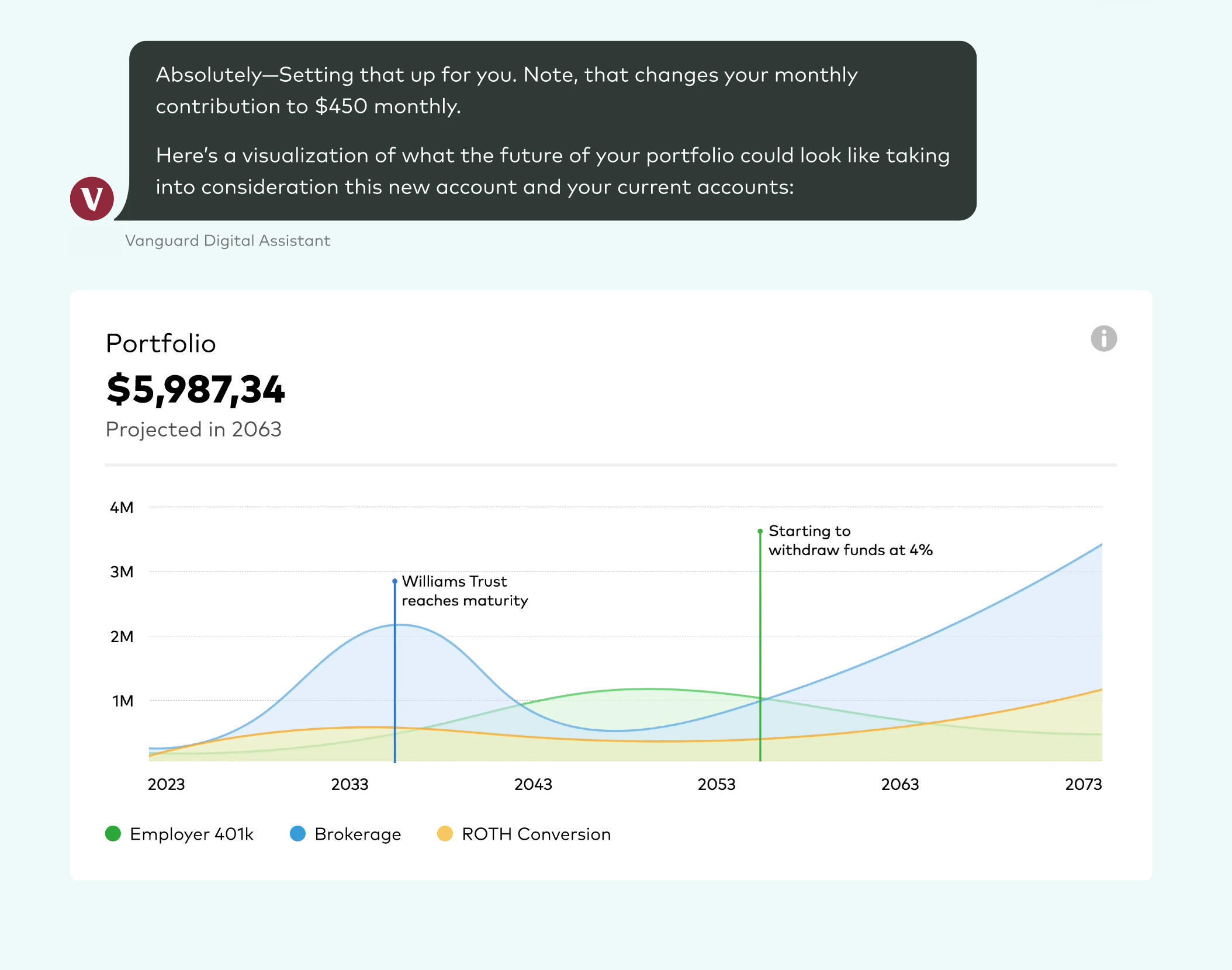

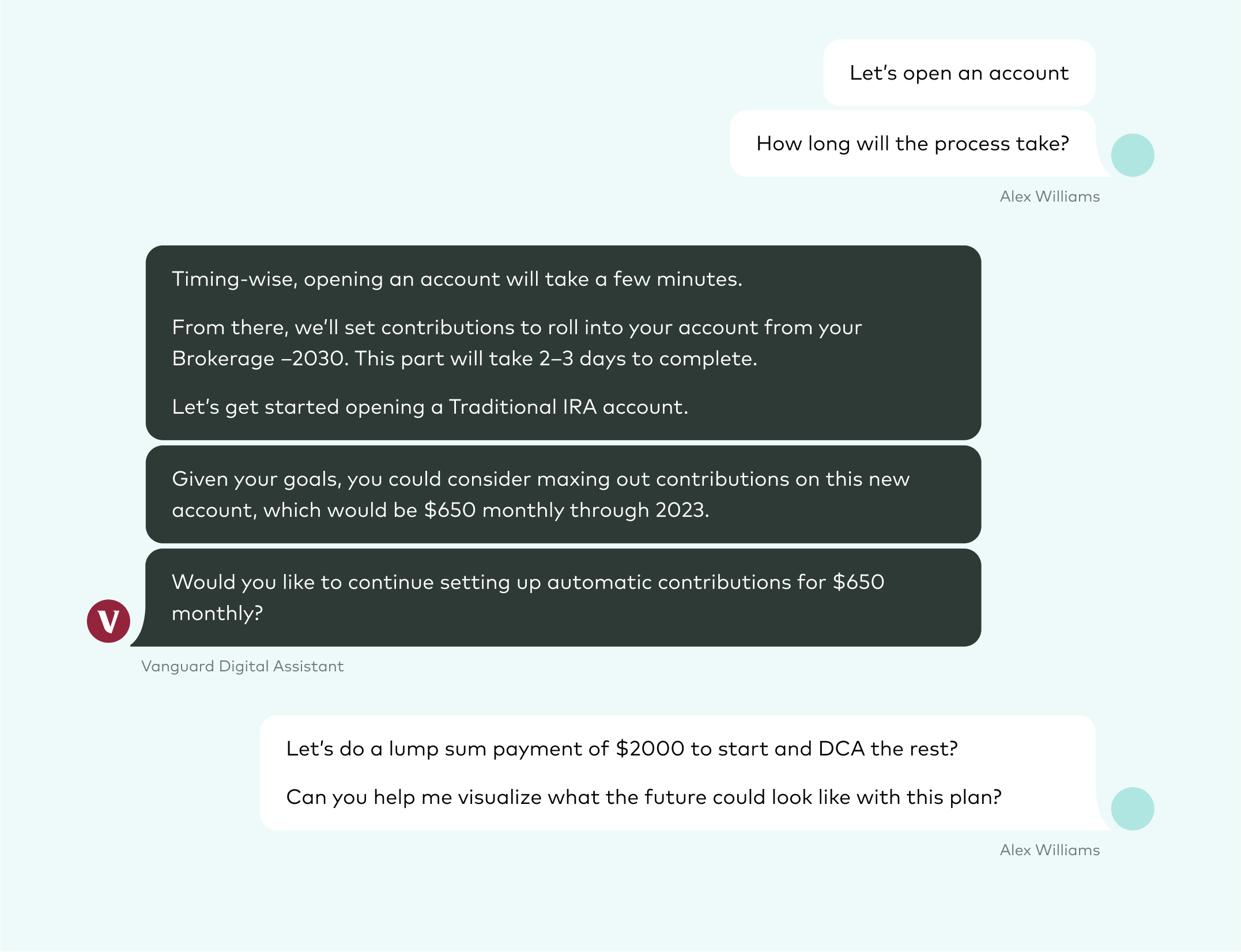

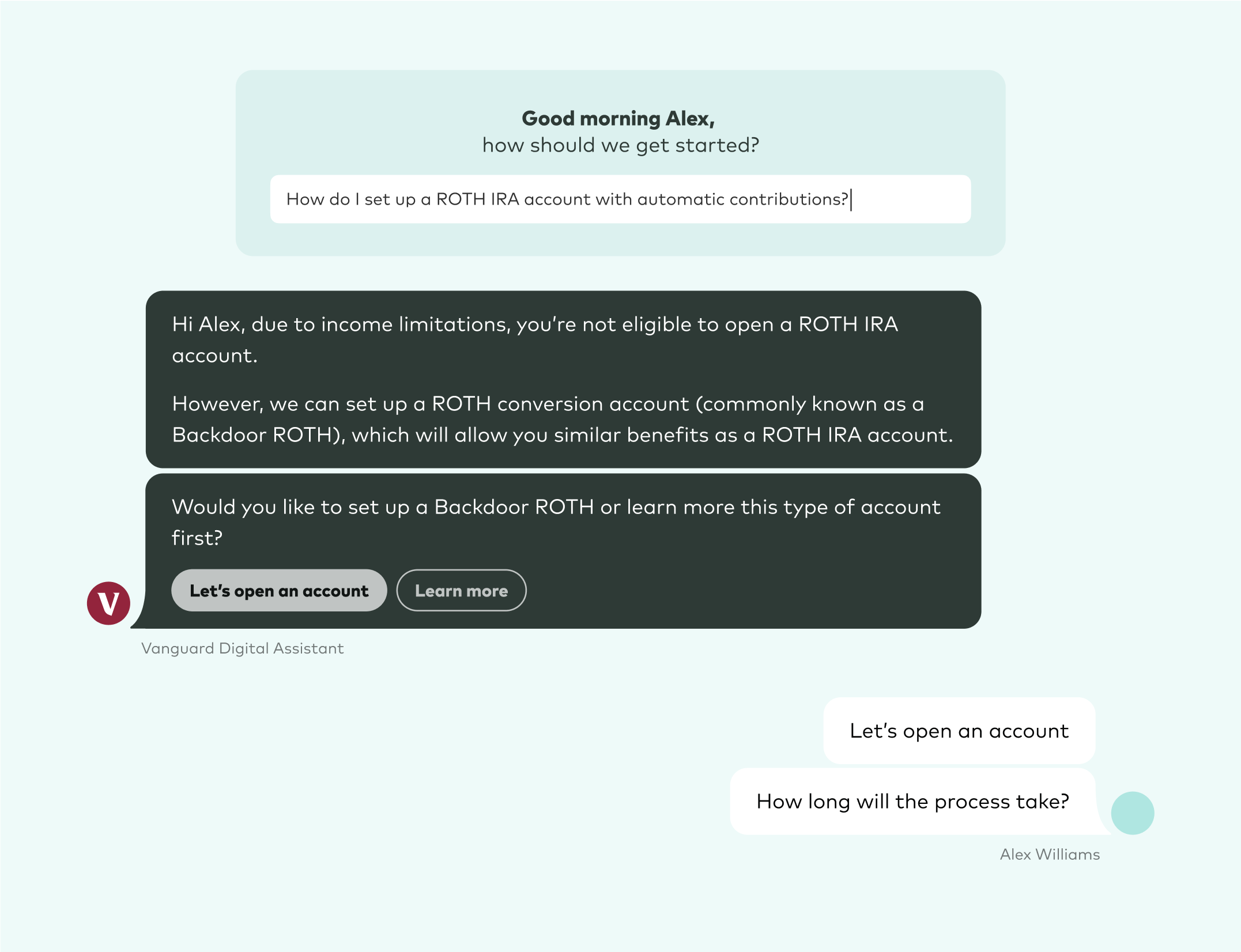

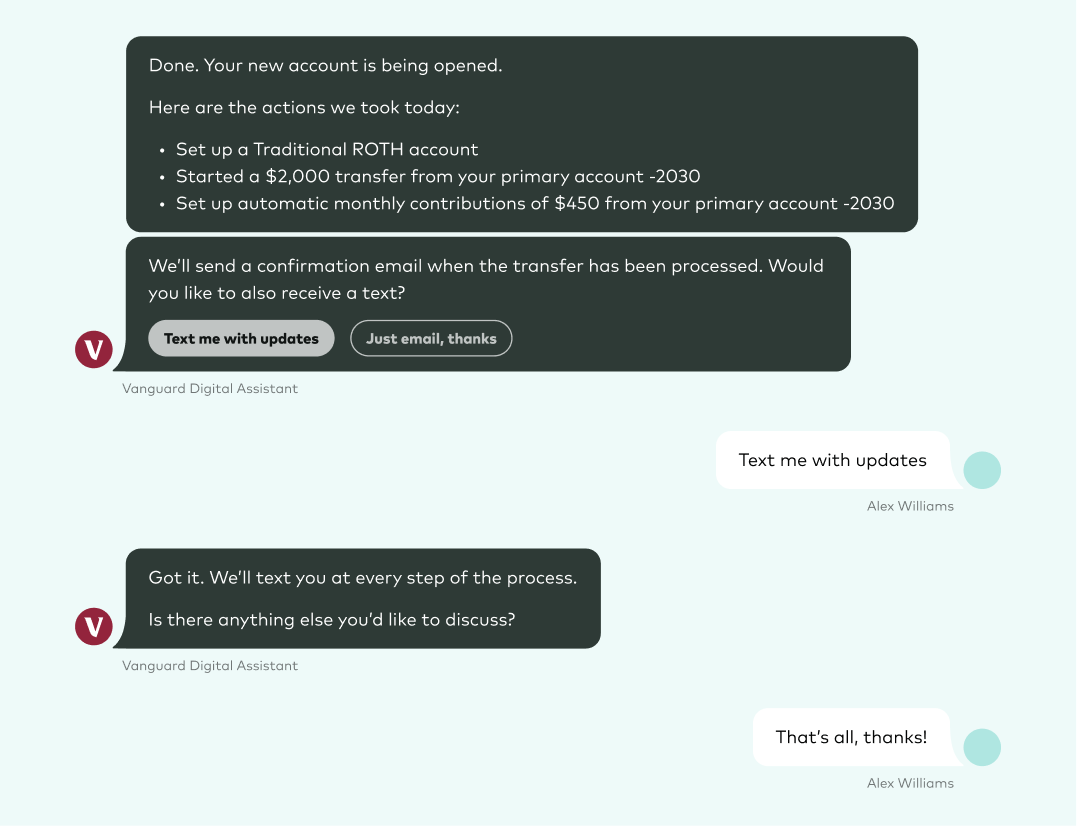

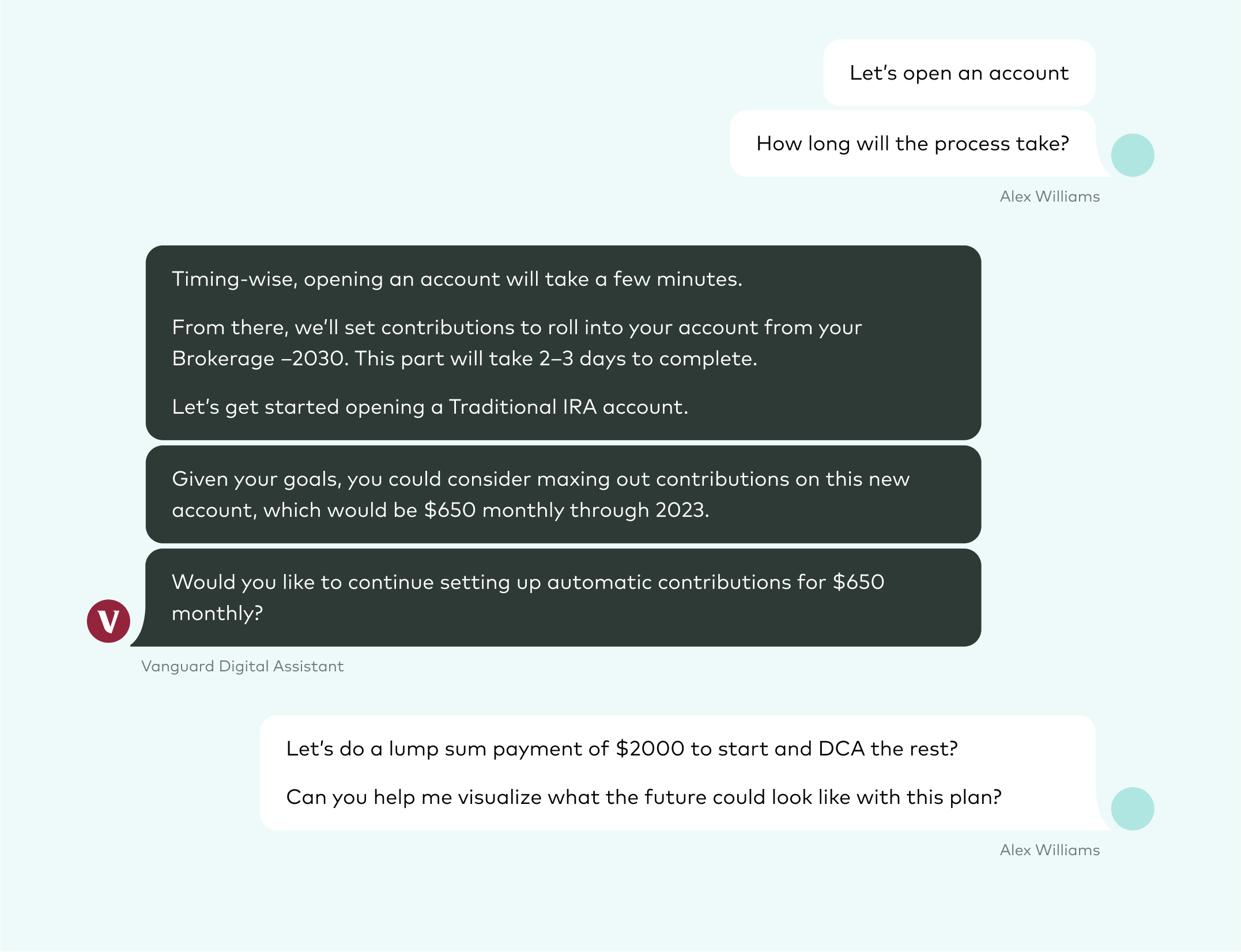

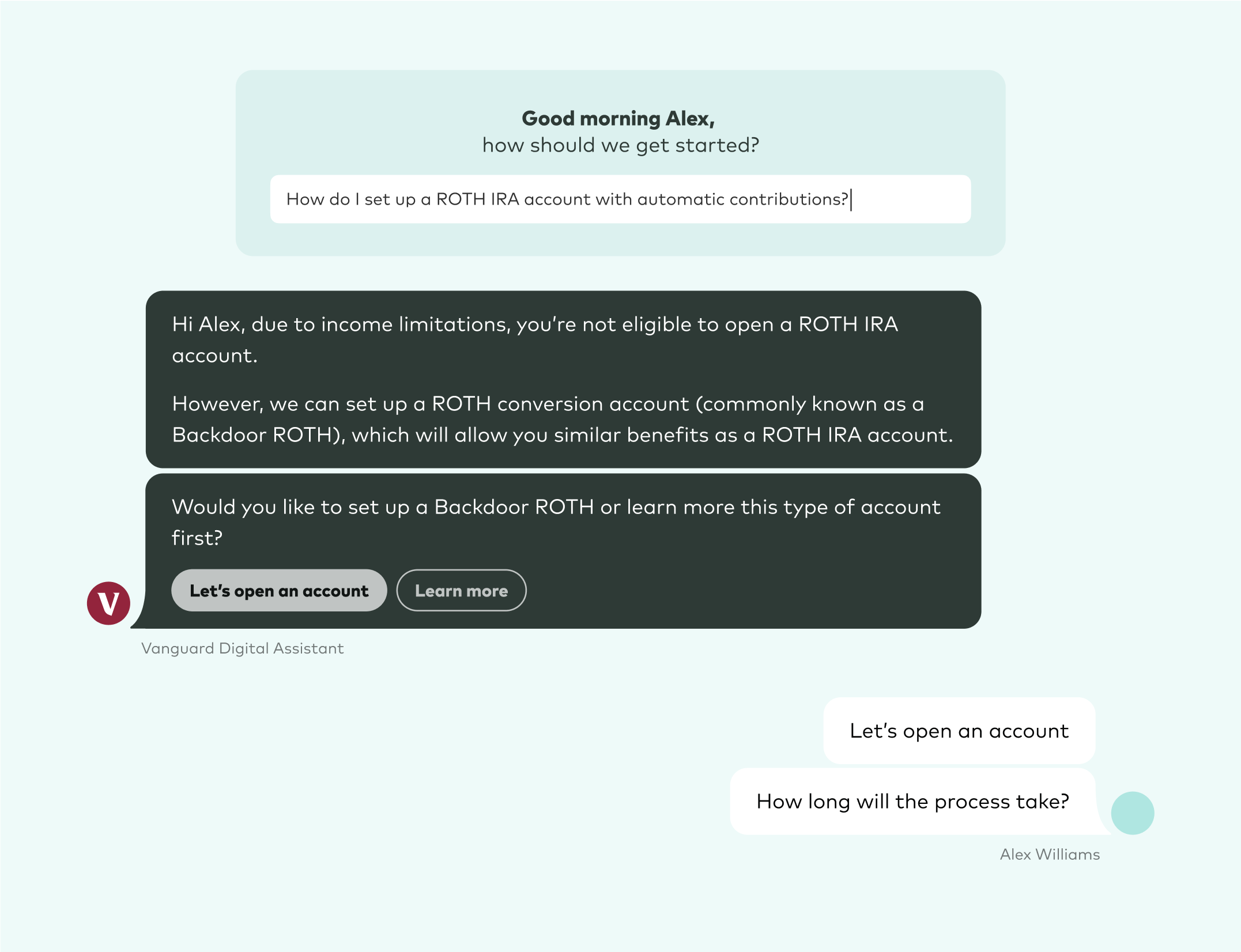

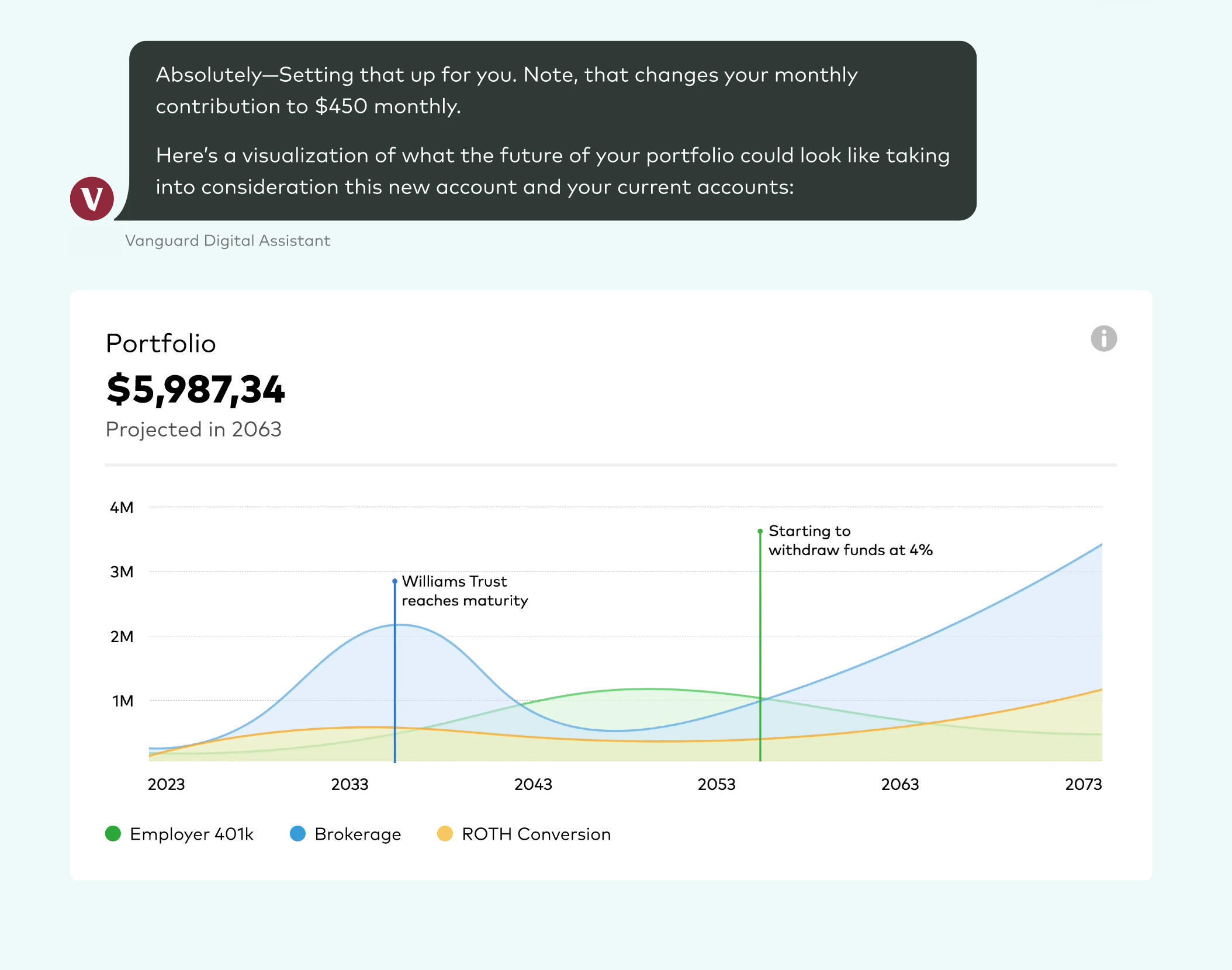

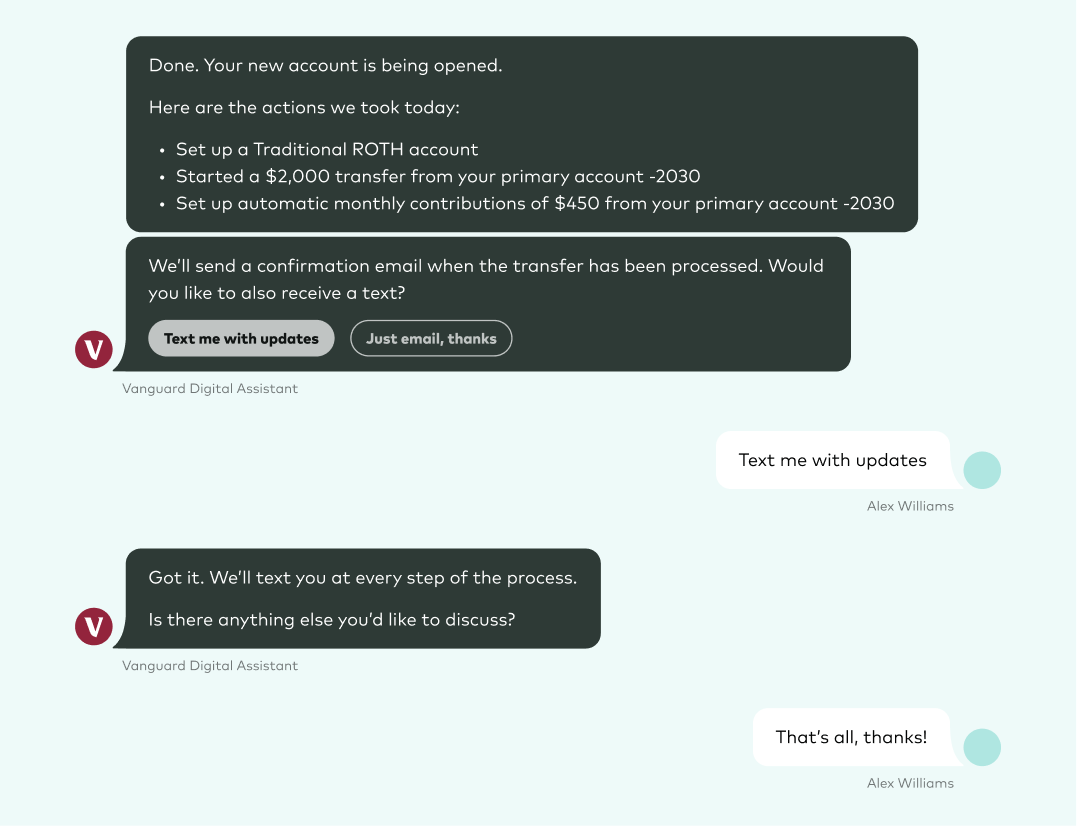

To bring our vision to life, we designed a hero conversation that solves for the above pain points, anchored around 3 experience pillars.

- Personalized + knowledgable

Understand users’ past, present, and future financial picture, mapped to the latest institutional regulations and considerations.

Provide contextual, helpful, and actionable next steps.

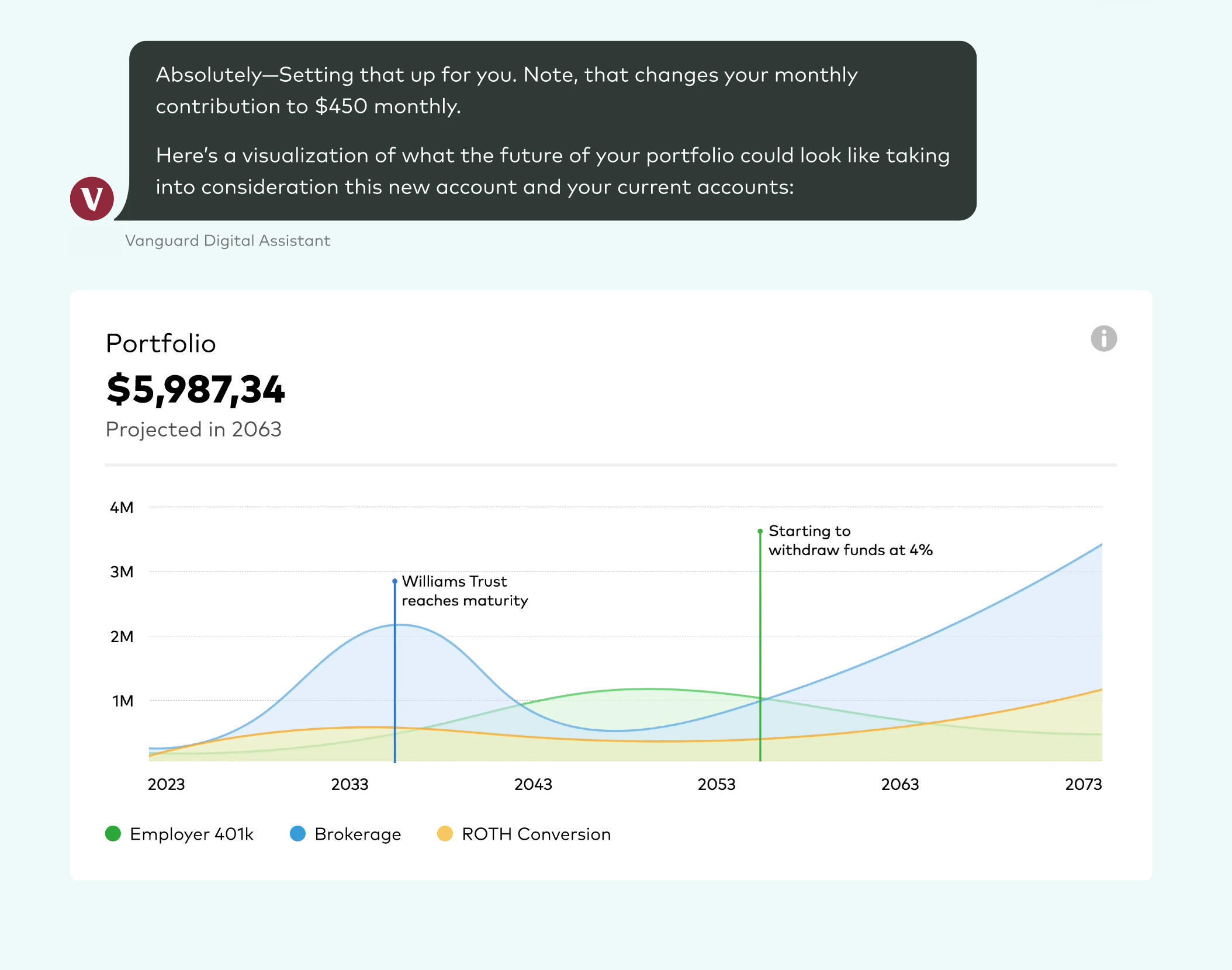

- Available + collaborative

Provide clarity to investors curious about scenarios and various outcomes in their portfolio.

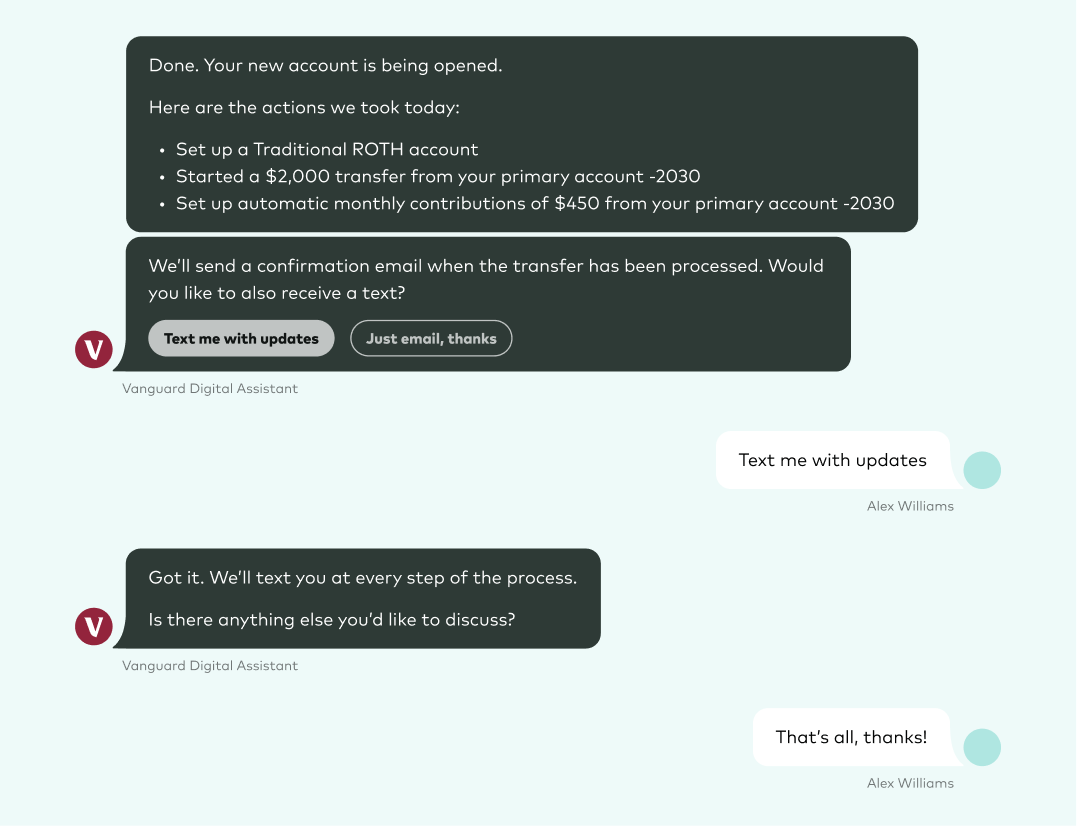

- Proactive + connected

Provide tailored visibility into processes and adaptable as user financial goals and preferences evolve.

Competitive edge

By building paths to our conversational AI model, we build an edge against competitors in two ways:

Product stickiness:

Build competitive advantage through user historical data and interactions.

Macro-scale insights:

Uncover bird’s-eye user patterns, highlighting key strategic overlaps for the organization.

Early validation + application

Early user interviews validated perceived user value in ease, helpfulness, and usefulness across test applications.

click to listen!

“It makes me extremely comfortable and confident.

I’m a person who hates bots and everything automated...

I love that this takes it.. and says—Okay, I’m going to do what you want me to do, and go to the advisor and approve it.

I think this is your strongest tool yet”

—Samantha, Personal Advisor Client

What’s next

We’ll continue to identify and validate low-lift ways to step into the full potential of this capability, while remaining user-centric in our discovery.

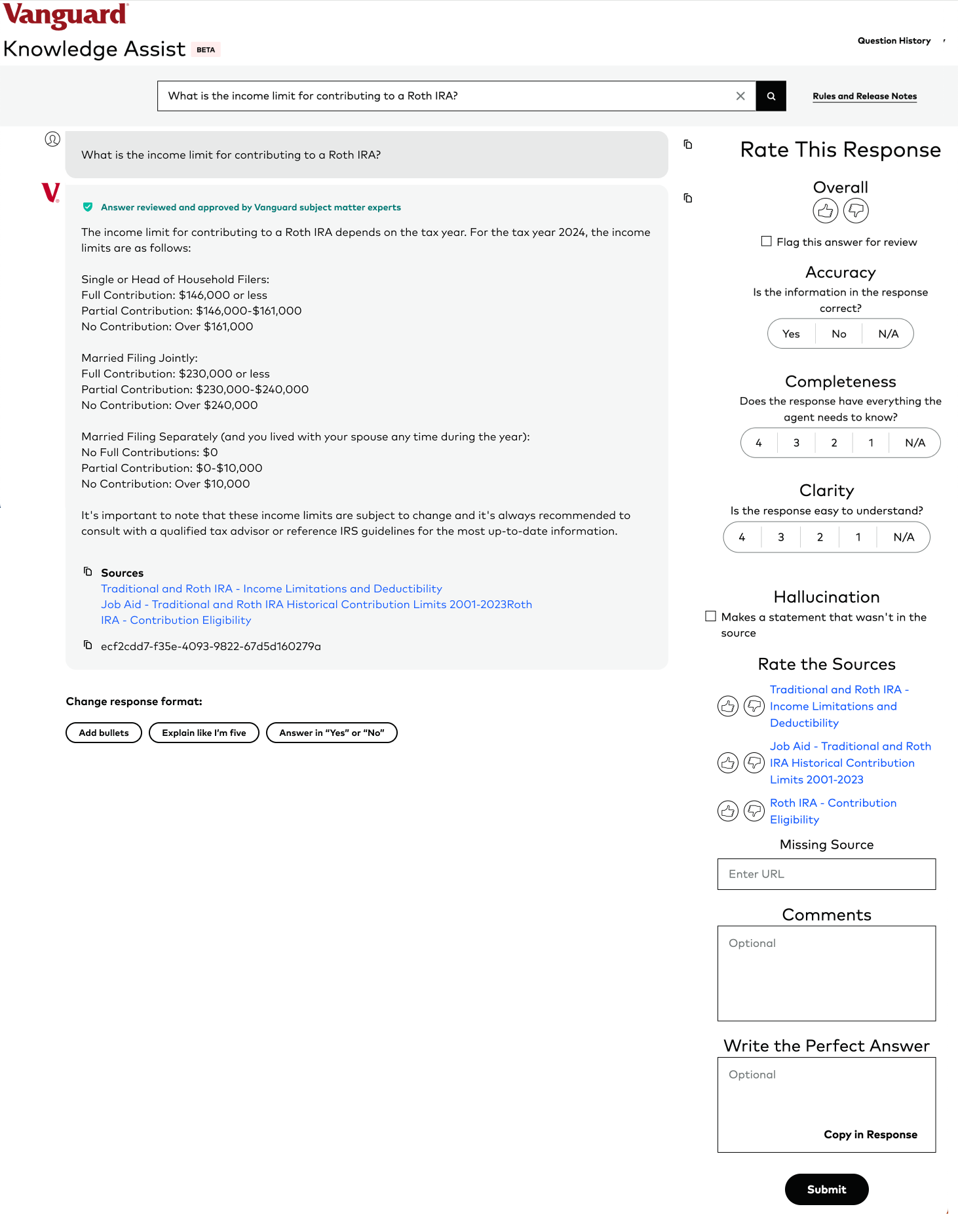

Our sister team used our proof of concept to test an internal AI beta for phone and chat support teams.

Opportunities for near experimentation

- Internal Conversational GenAI to help improve chat support expertise and efficiency.

- Phone transcripts and summaries to improve continuity in relationship and case handling.

- Wayfinding GenAI pilots as a low-risk path to navigate regulatory and ethical limitations.

Janie Sanchez

About

Hi there, I’m Janie, a design strategist turning complexity into clarity for people, teams, and futures.

Currently designing at Vanguard to help make financial goals feel actionable.

Wondering about the red underline? Ask me about it in computer class.

reach out: hello@janiesanchez.com

Hi there, I’m Janie, a design strategist turning complexity into clarity for people, teams, and futures.

Currently designing at Vanguard to help make financial goals feel actionable.

Wondering about the red underline? Ask me about it in computer class.

reach out: hello@janiesanchez.com

The ChallengeThe rise of mainstream Generative AI in 2023 marked an inflection point, reshaping competitive capabilities and redefining user expectations.

My RoleAs a designer and strategist, I helped define the full potential of this capability as a way to close current user gaps and future-proof our offering.

To scale toward this vision, I outlined clear, actionable paths that bridged near-term feasibility with long-term ambition.

Gap focus 1:

Human Connections

Exploring GenAI started with a core truth: Relationships matter at Vanguard, but there are gaps in how human connection takes place.

Happy

- Connection feels deeply human and personalized

- Advisor is proactive, prepared, and shares important knowledge

- Expectations are set and met without surprises

Eh

- Spotty availability

- Inconsistent or impersonal connection

Frustrated

- Surface-level connection

- Unavailable advisor or unapproachable

- Interruptions due to advisor turnover

Key satisfaction gaps

- Our research at Vanguard found that client satisfaction with personal advice varied widely.

- My synthesis connected gaps that GenAI could help fill in existing relationships, and that we could also scale to self-directed investors that don’t yet have a personal advisor via an experience that is:

- Personalized + knowledgable

- Available + collaborative

- Proactive + connected

Gap focus 2:

Wayfinding

Pain points in wayfinding and navigation account for 18% of all user survey comments across digital channels.

Solving for use cases

To bring our vision to life, we designed a hero conversation that solves for the above pain points, anchored around 3 experience pillars.

- Personalized + knowledgable

Understand user’s past, present, and future financial picture, mapped to the latest institutional regulations and considerations.

Provide contextual, helpful, and actionable next steps.

- Available + collaborative

Provide clarity to investors curious about scenarios and various outcomes in their portfolio.

- Proactive + connected

Provide tailored visibility into processes and adaptable as user financial goals and preferences evolve.

Competitive edge

By building paths to our conversational AI model, we build an edge against competitors in two ways:

Product stickiness:

Build competitive advantage through user historical data and interactions.

Macro-scale insights:

Uncover bird’s-eye user patterns, highlighting key strategic overlaps for the organization.

Early validation + application

Early user interviews validated perceived user value in ease, helpfulness, and usefulness across test applications.

click to listen!

“It makes me extremely comfortable and confident.

I’m a person who hates bots and everything automated...

I love that this takes it.. and says—Okay, I’m going to do what you want me to do, and go to the advisor and approve it.

I think this is your strongest tool yet”

—Samantha, Personal Advisor Client

What’s next

We’ll continue to identify and validate low-lift ways to step into the full potential of this capability, while remaining user-centric in our discovery.

Our sister team used our proof of concept to test an internal AI beta for phone and chat support teams.

Opportunities for near experimentation

- Internal Conversational GenAI to help improve chat support expertise and efficiency.

- Phone transcripts and summaries to improve continuity in relationship and case handling.

- Wayfinding GenAI pilots as a low-risk path to navigate regulatory and ethical limitations.

Janie Sanchez

About

Hi there, I’m Janie, a design strategist turning complexity into clarity for people, teams, and futures.

Currently designing at Vanguard to help make financial goals feel actionable.

Wondering about the red underline? Ask me about it in computer class.

reach out: hello@janiesanchez.com

Hi there, I’m Janie, a design strategist turning complexity into clarity for people, teams, and futures.

Currently designing at Vanguard to help make financial goals feel actionable.

Wondering about the red underline? Ask me about it in computer class.

reach out: hello@janiesanchez.com

The ChallengeThe rise of mainstream Generative AI in 2023 marked an inflection point, reshaping competitive capabilities and redefining user expectations.

My RoleAs a designer and strategist, I helped define the full potential of this capability as a way to close current user gaps and future-proof our offering.

To scale toward this vision, I outlined clear, actionable paths that bridged near-term feasibility with long-term ambition.

Gap focus 1:

Human Connections

Exploring GenAI started with a core truth: Relationships matter at Vanguard, but there are gaps in how human connection takes place.

Happy

- Connection feels deeply human and personalized

- Advisor is proactive, prepared, and shares important knowledge

- Expectations are set and met without surprises

Eh

- Spotty availability

- Inconsistent or impersonal connection

Frustrated

- Surface-level connection

- Unavailable advisor or unapproachable

- Interruptions due to advisor turnover

Key satisfaction gaps

- Our research at Vanguard found that client satisfaction with personal advice varied widely.

- My synthesis connected gaps that GenAI could help fill in existing relationships, and that we could also scale to self-directed investors that don’t yet have a personal advisor via an experience that is:

- Personalized + knowledgable

- Available + collaborative

- Proactive + connected

Gap focus 2:

Wayfinding

Pain points in wayfinding and navigation account for 18% of all user survey comments across digital channels.

Solving for use cases

To bring our vision to life, we designed a hero conversation that solves for the above pain points, anchored around 3 experience pillars.

- Personalized + knowledgable

Understand user’s past, present, and future financial picture, mapped to the latest institutional regulations and considerations.

Provide contextual, helpful, and actionable next steps.

- Available + collaborative

Provide clarity to investors curious about scenarios and various outcomes in their portfolio.

- Proactive + connected

Provide tailored visibility into processes and adaptable as user financial goals and preferences evolve.

Competitive edge

By building paths to our conversational AI model, we build an edge against competitors in two ways:

Product stickiness:

Build competitive advantage through user historical data and interactions.

Macro-scale insights:

Uncover bird’s-eye user patterns, highlighting key strategic overlaps for the organization.

Early validation + application

Early user interviews validated perceived user value in ease, helpfulness, and usefulness across test applications.

click to listen!

“It makes me extremely comfortable and confident.

I’m a person who hates bots and everything automated...

I love that this takes it.. and says—Okay, I’m going to do what you want me to do, and go to the advisor and approve it.

I think this is your strongest tool yet”

—Samantha, Personal Advisor Client

What’s next

We’ll continue to identify and validate low-lift ways to step into the full potential of this capability, while remaining user-centric in our discovery.

Our sister team used our proof of concept to test an internal AI beta for phone and chat support teams.

Opportunities for near experimentation

- Internal Conversational GenAI to help improve chat support expertise and efficiency.

- Phone transcripts and summaries to improve continuity in relationship and case handling.

- Wayfinding GenAI pilots as a low-risk path to navigate regulatory and ethical limitations.