Janie Sanchez

Hi there, I’m Janie, a design strategist turning complexity into clarity for people, teams, and futures.

Currently designing at Vanguard to help make financial goals feel actionable.

Wondering about the red underline? Ask me about it in computer class.

reach out: hello@janiesanchez.com

Welcome back, Julia

$78,403.00

Value as of:

June 30, 2025, 11:40 a.m., Eastern time

Last login:

June 30, 2025, 11:40 a.m., Eastern time

Dashboard

Balances

Holdings

Activity

Performance

Goals

Portfolio watch

Your full goals forecast

1 year

5 years

10 years

Lifetime

2020

2025

2030

2035

2040

2045

2050

2055

2060

2065

2M

1.75M

1.25M

1M

600k

300k

0k

💰

Emergency fund reached

Growing at 3.7% interest

✏️

! Off track

Alex’s education target is off track

Align your contributions to meet this goal

⛰️

Retirement fund half-funded

Compound interest projected building up

⛰️

Retirement fund in use

Starting to withdraw funds at 6%

Display:

All goals

⛰️

Retirement

💰

Emergency fund

✏️

Alex’s education fund

The ChallengePeople aspire to lead their finances with confidence, but find financial planning and investing confusing and intimidating.

My RoleAs the product designer, I mapped discovery priorities to guide user towards Vanguard’s investing principles through bite-sized, confidence-building user actions.

As the UX lead on a multidisciplinary team, I shape our product proof-of-concept and launched a pilot on track to exceed $160–426M in annual client value.

march 2024

Understanding Industry + Social Trends

Resources for self-managed portfolios range in clunky → high-risk.

Rise of social trading

Nearly half of consumers (49%) rely on finfluencers for investment advice (BrokerChooser), yet 80% of forex content on TikTok is potentially misleading—undermining long-term financial goals.

Rise of betting markets

Speculative platforms like Polymarket ($9B volume, 314K traders, The Block) are drawing attention.

For every $1 spent on betting, households invest $2 less (KelloggInsight), signaling a shift toward riskier behaviors.

april 2024

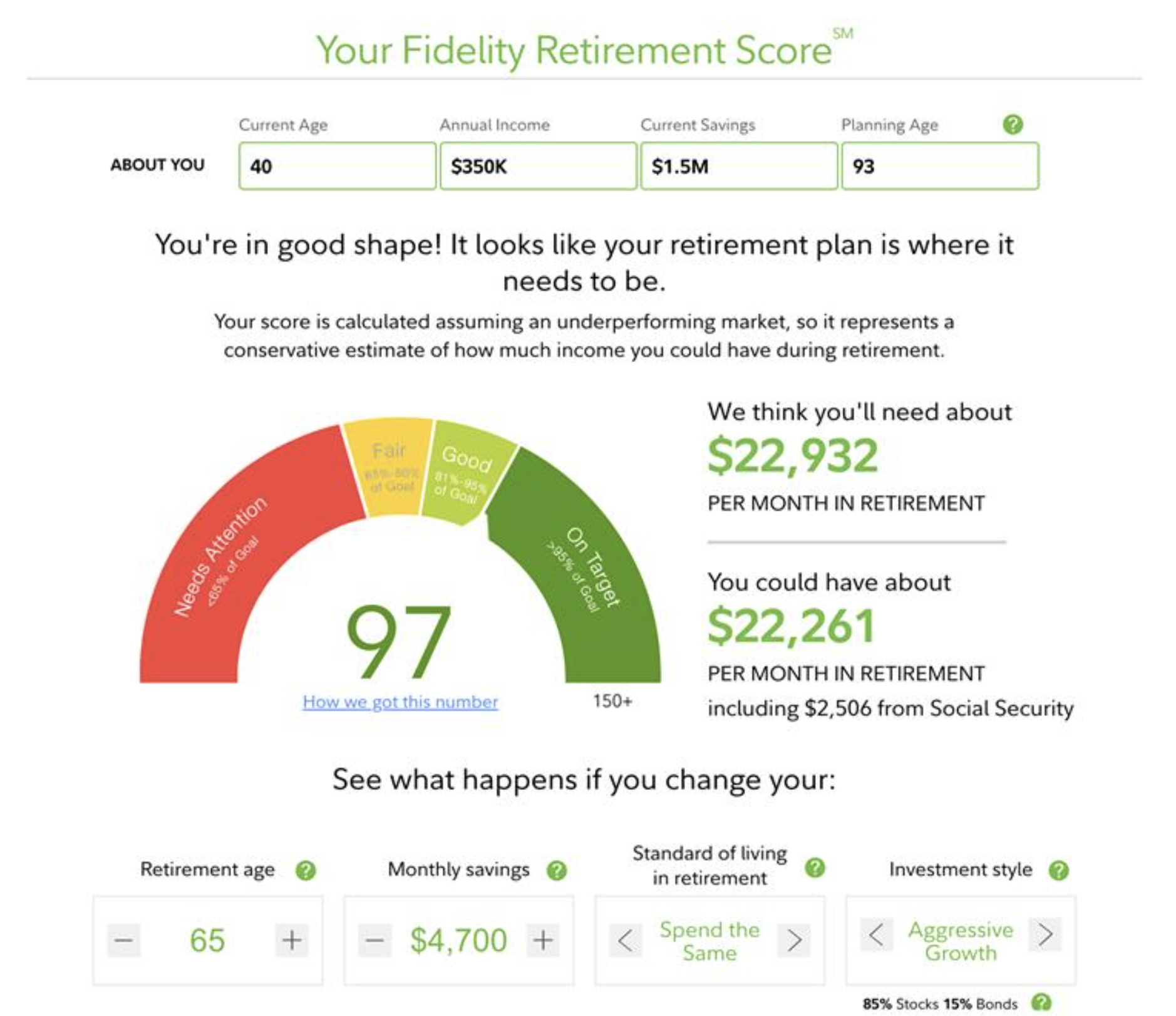

Establishing our Competitive Advantage

Vanguard is uniquely positioned to lead with integrated, goal-based experiences.

Everything Vanguard knows about investing, documented:

Vanguards_guide_to_financial_wellness.pdf — 52 pages

Vanguard’s investing resources: dense + comprehensive,

Let’s make them personalized + actionable.

Vanguard experiences: Built on 50 years of trust

1975 | Vanguard launches the world’s 1st index fund, pioneering low-cost investing and diversification for everyday Americans 50 years ago.

2025 | Vanguard’s expertise and client trust run deep, founded in investor ownership built over millions of interactions.

Everything we know about holistic personal finance is well-documented and easily accessed, but it’s in 52-page PDF.

April–June 2024

Discovery strategy

- What gaps exist between how people should invest and how they actually do?

- How can we design systems that bridge that gap—intuitively, confidently, and at scale?

Investmentprinciples

Userbehavior

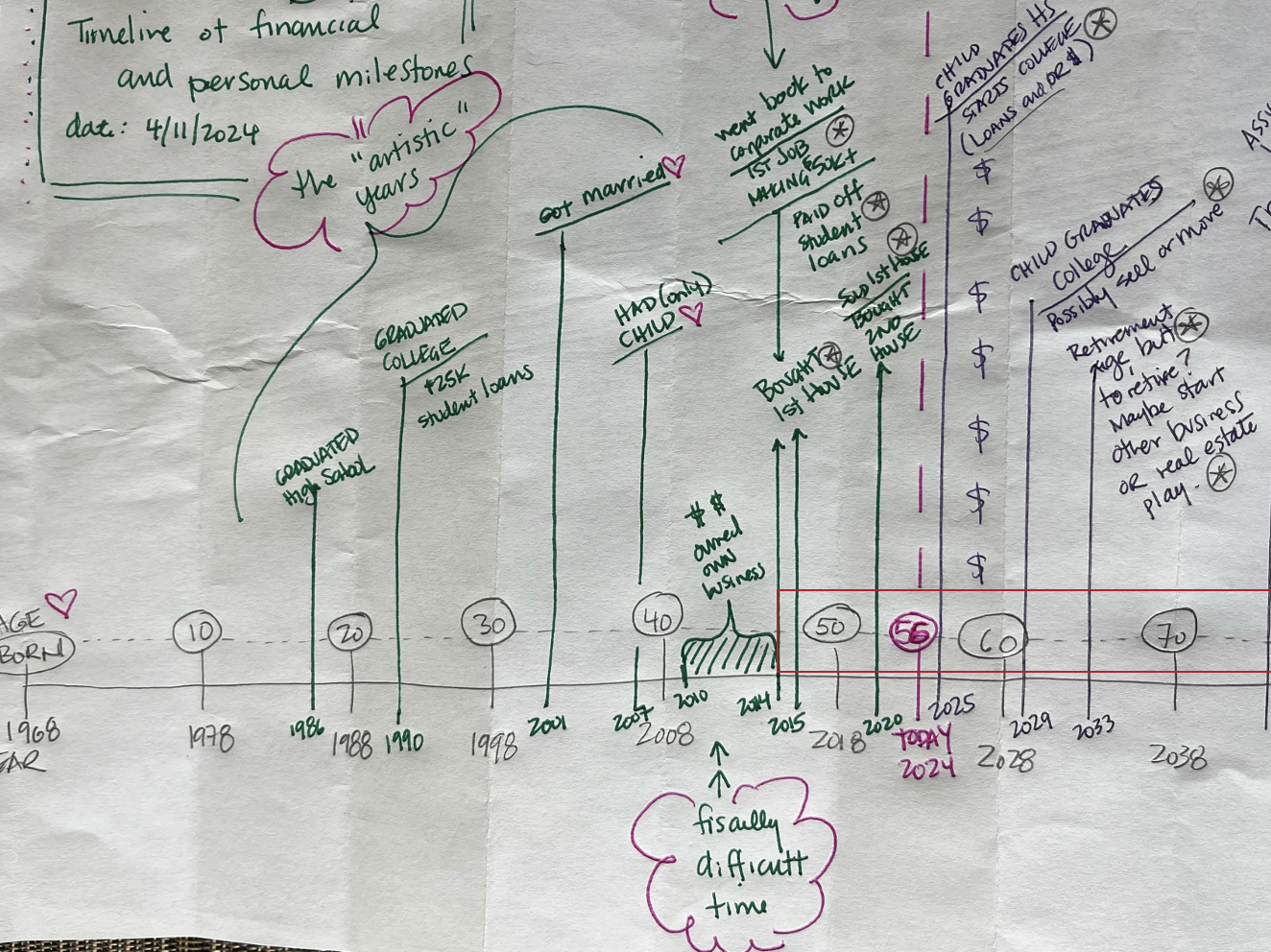

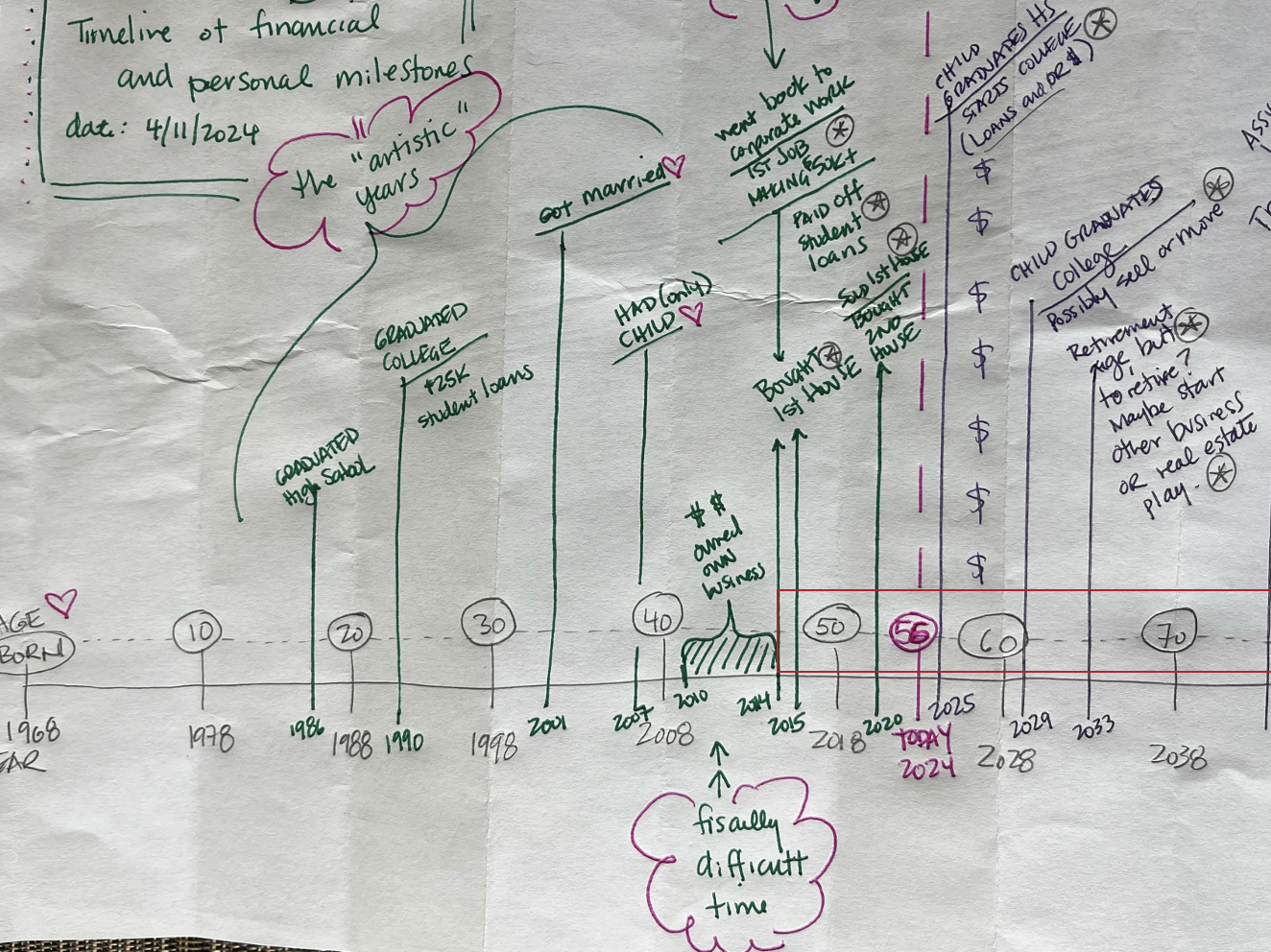

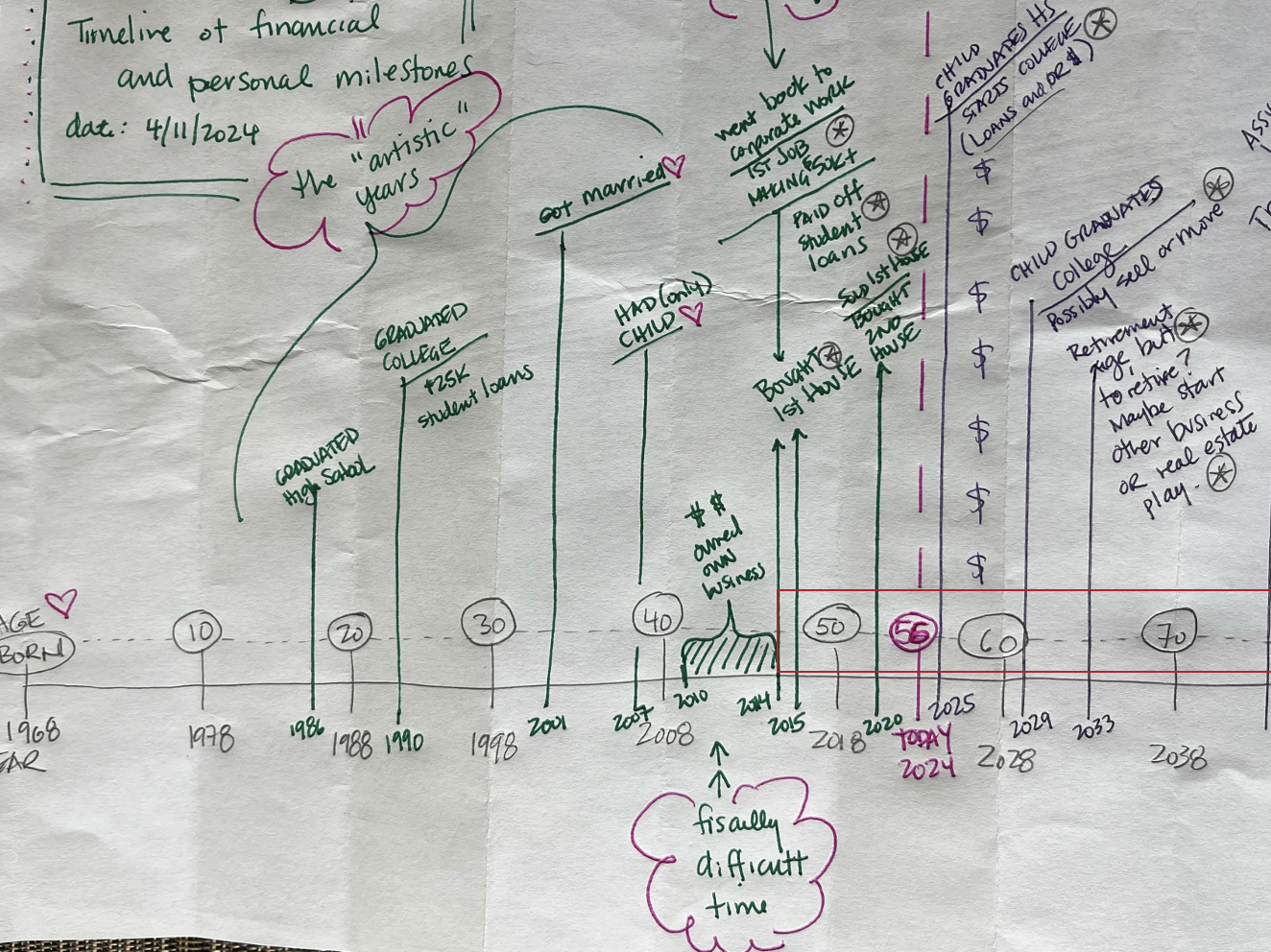

Participants drew their past and future savings and financial planning timelines, which revealed that financial decisions are often tied to pivotal life events.

User discovery methods

- 2 two-week diary studies (+ design missions)

- 24 user interviews

- Many feedback surveys

- 65 unmoderated tests

- 120+ days of quantitative engagement analysis

June–July 2024

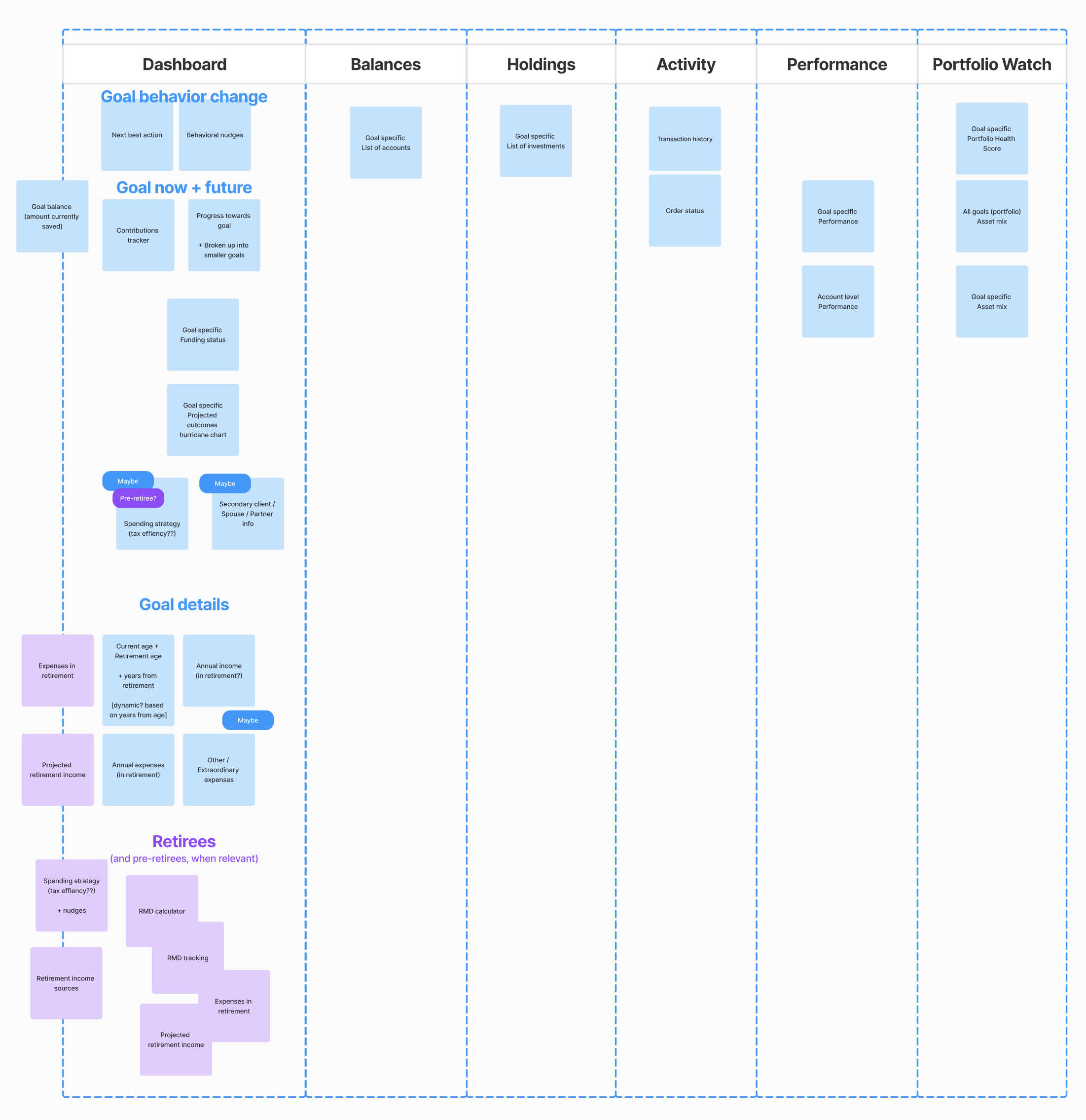

User insights → features

Users’ financial mental models largely mirror Vanguard’s philosophy, but lack clarity around key areas. Our team ideated around specific synthesis areas.

“What if we sold our house? What would we do with the money? I haven't really seen a kind of a cascading scenario tool, and I would appreciate that.”

—Kristen, 29

Experience theme

Bite-sized”Help me withincremental steps”

Directional”Help me choosewhat to invest in”

Exploratory”What happens if I contribute $20 more monthly?”

Future-proof”How do I stay on track?”

→

August 2024

Defining our pilot audience: early accumulators

Users who are just getting started investing value a simpler way to build growth, making them an ideal fit for our early pilot.

DEcember 2024

Establishing our product vision

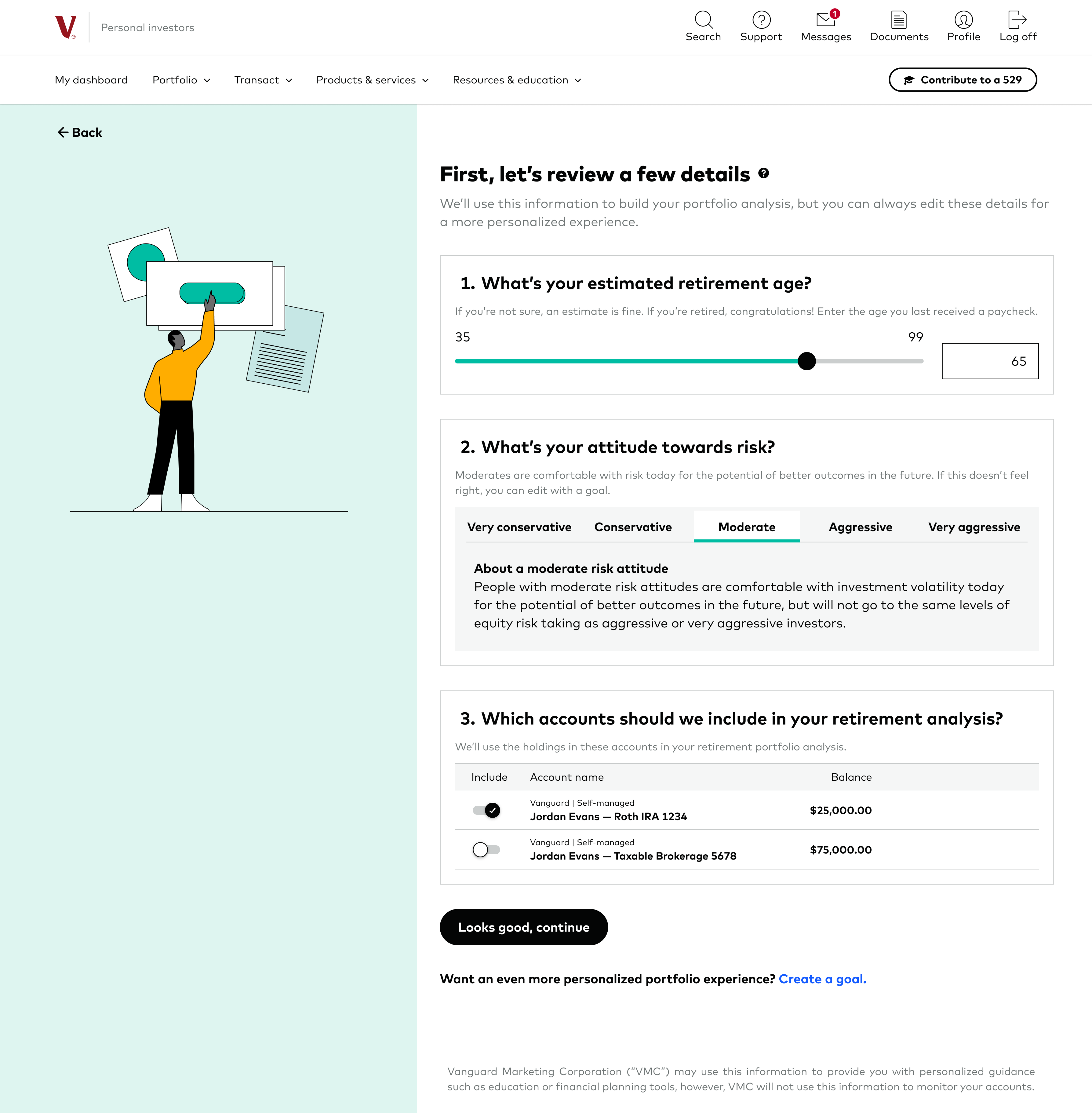

Early concept definition focuses on a full and comprehensive goal-planning and tracking experience.

“Help me understand the nitty gritty.Tell me everything about my retirement goal.”

Personal investors

Support

1

Log off

My dashboard

Portfolio

Transact

Products & services

Resources & education

Contribute to a 529

Welcome back, Julia

$78,403.00

Value as of:

June 30, 2025, 11:40 a.m., Eastern time

Last login:

June 30, 2025, 11:40 a.m., Eastern time

Dashboard

Balances

Holdings

Activity

Performance

Goals

Portfolio watch

All Goals

Your full goals forecast

You’re projected to have $12,500 monthly in retirement.

That’s about $1,200 more than you may need. That could mean earlier retirement or more travel.

2020

2030

2040

2050

2060

2065

2070

2M

1.75M

1.25M

1M

600k

300k

0k

⛰️

Retirement fund half funded

Compound interest projected building up

⛰️

Retirement fund in use

Starting to withdraw funds ($11,300/mo)

Retirement contributions

$403,554.00

Target: $1,750,000

Funding: $1,600 monthly

✓ on track

Accounts:

- Roth IRA (4021) — $73,000.00

- Employer 401k (6395) — $205,534.00

- Brokerage (2052) — $25,020.00

Edit goal

Retirement diversification

! off track

Less

diversified

Asset mix

! off track

Global stock exposure

✓ on track

Single-stock concentration

✓ on track

Review your mix of investments

Based on your targets, your investment allocation could be more optimized.

Review portfolio →

Your action plan

Set up your retirement goal

- Diversify your portfolio

Your portfolio does not reflect your current risk profile: 90% stocks, 10% bonds.

Review your mix of investments

Based on your targets, your investment allocation could be more optimized.

Review portfolio analysis →

- Contribute to your plan

There are some optimization actions you could take.

Set up automatic contributions

Set up your account to automatically make contributions and keep your goal on track.

Set up contributions →

4 more actions

Your activity

June 12, 2025

You hit a 12-month contribution streak! Nice work.

April 12, 2025

You increased your contributions by $250.

April 12, 2025

You made your first transfer.

8 more actions

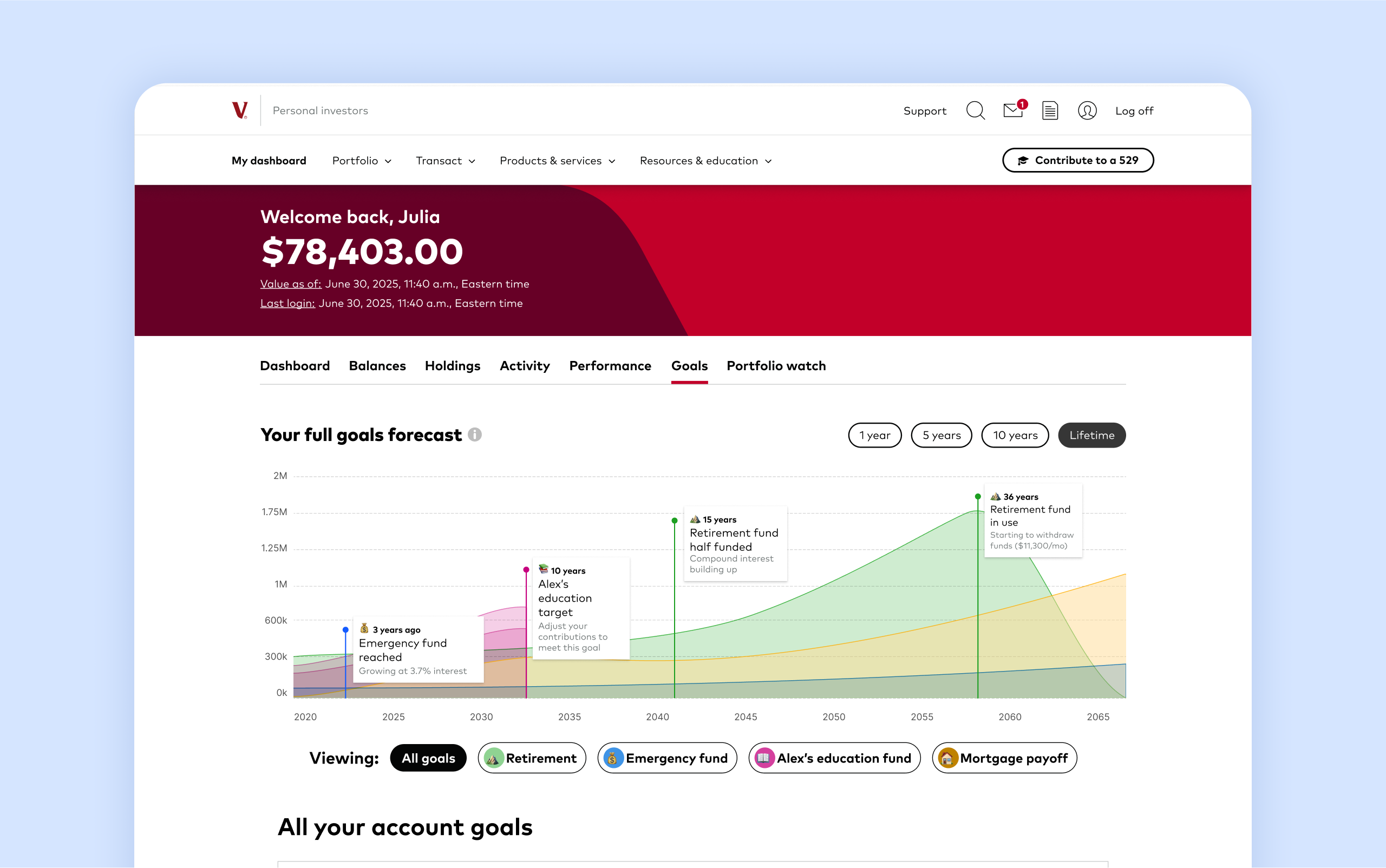

Action list

Mitigate decision paralysis.

Numerical projection

Give a tangible ballpark of retirement cashflow.

Milestone projection

Make goals feel closer and more achievable.

Contribution status

List contribution and goal details.

Activity log

Celebrate momentum.

“Help me understand the full picture. Tell me about all my goals together.”

January–April 2025

Pilot + Learning

Yes!

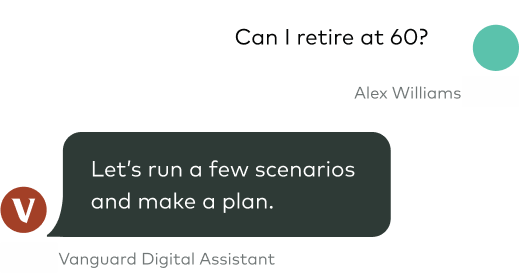

We saw increased confidence and clarity in decision-making, validating our hypothesis around perceived value in scenario modeling and behavioral nudges.

But, let’s make it better.

Users continue to disengage with a goals experience if it feelstoo complex or time-intensive without a clear perceived benefit.

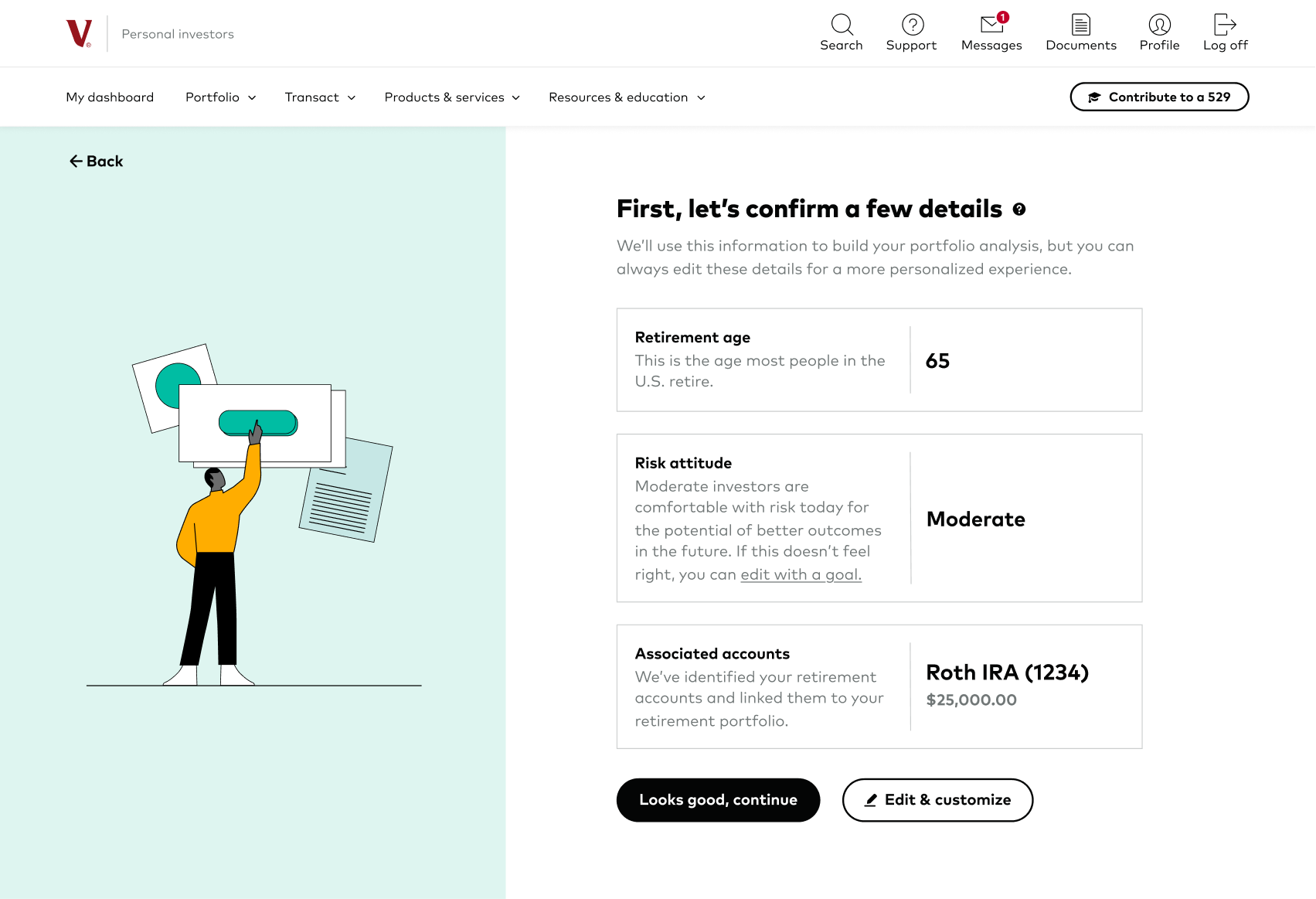

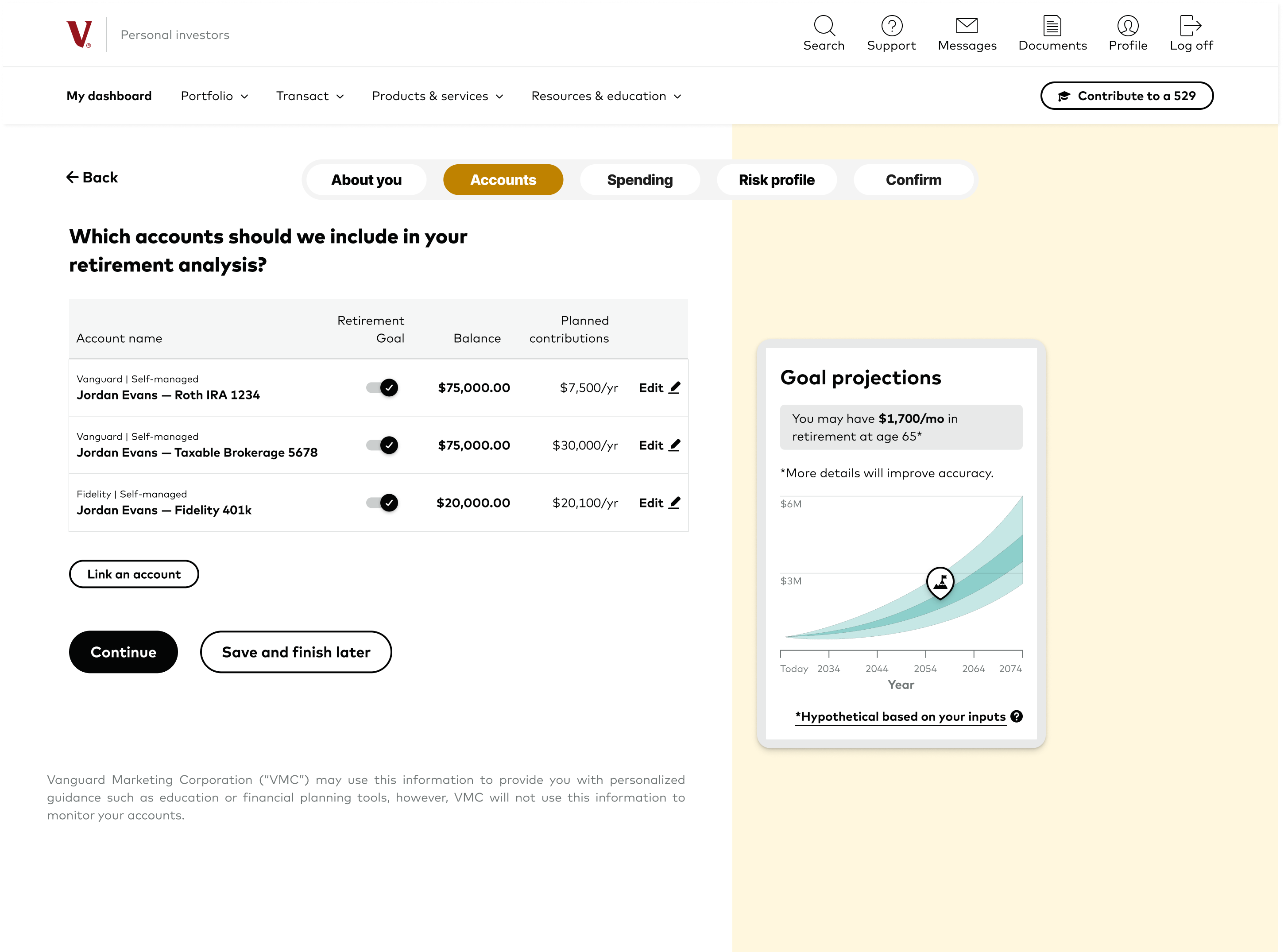

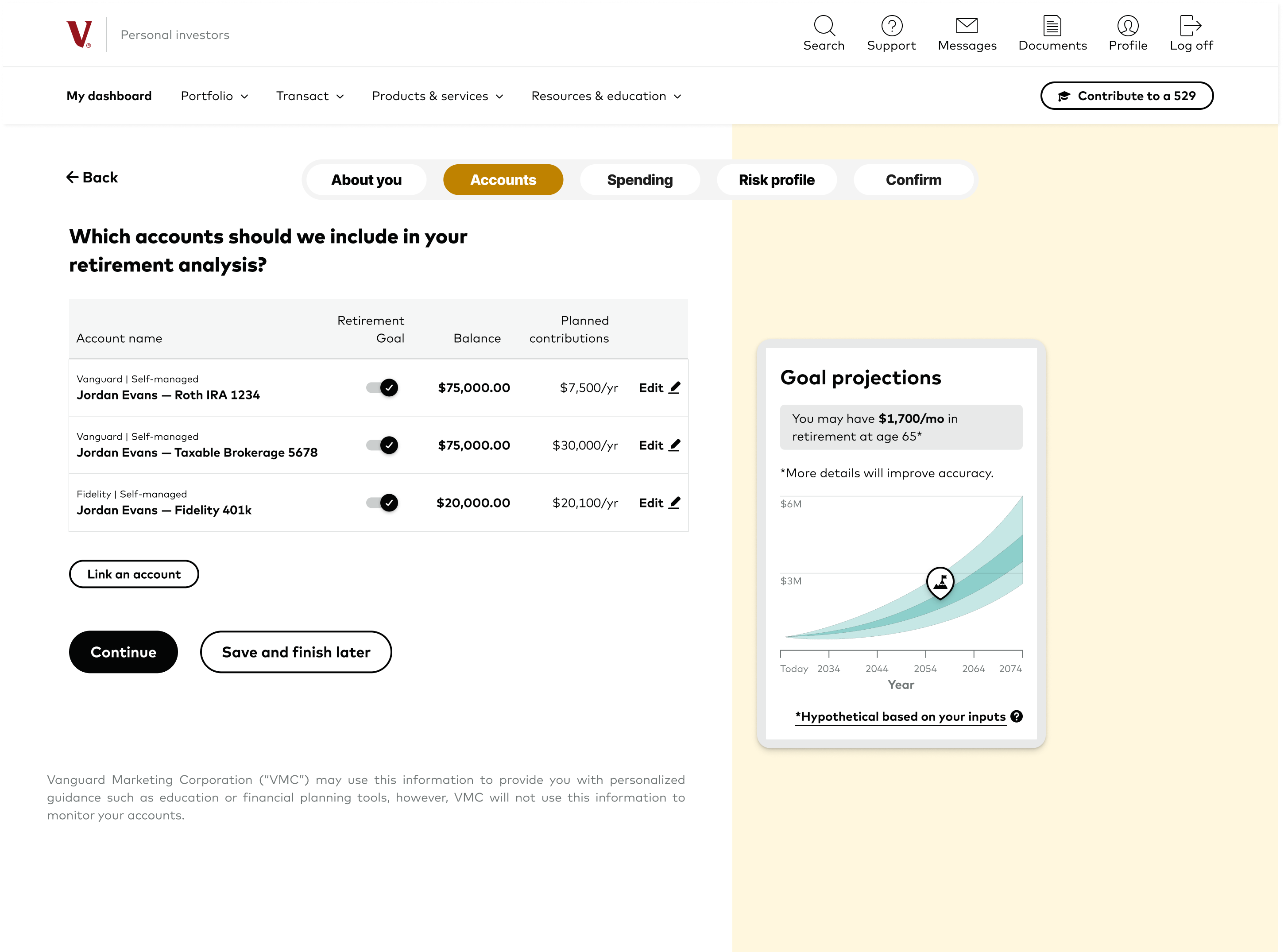

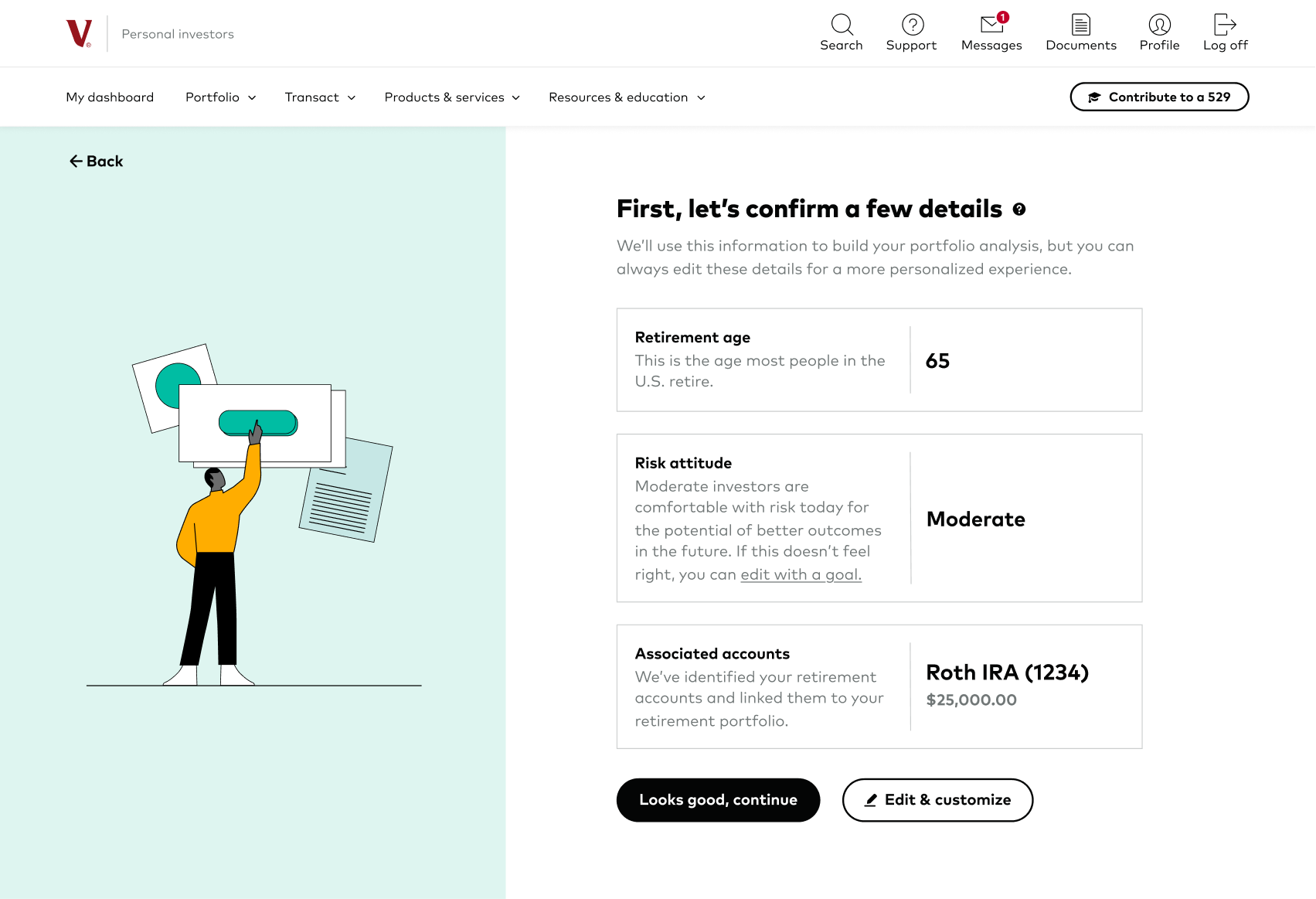

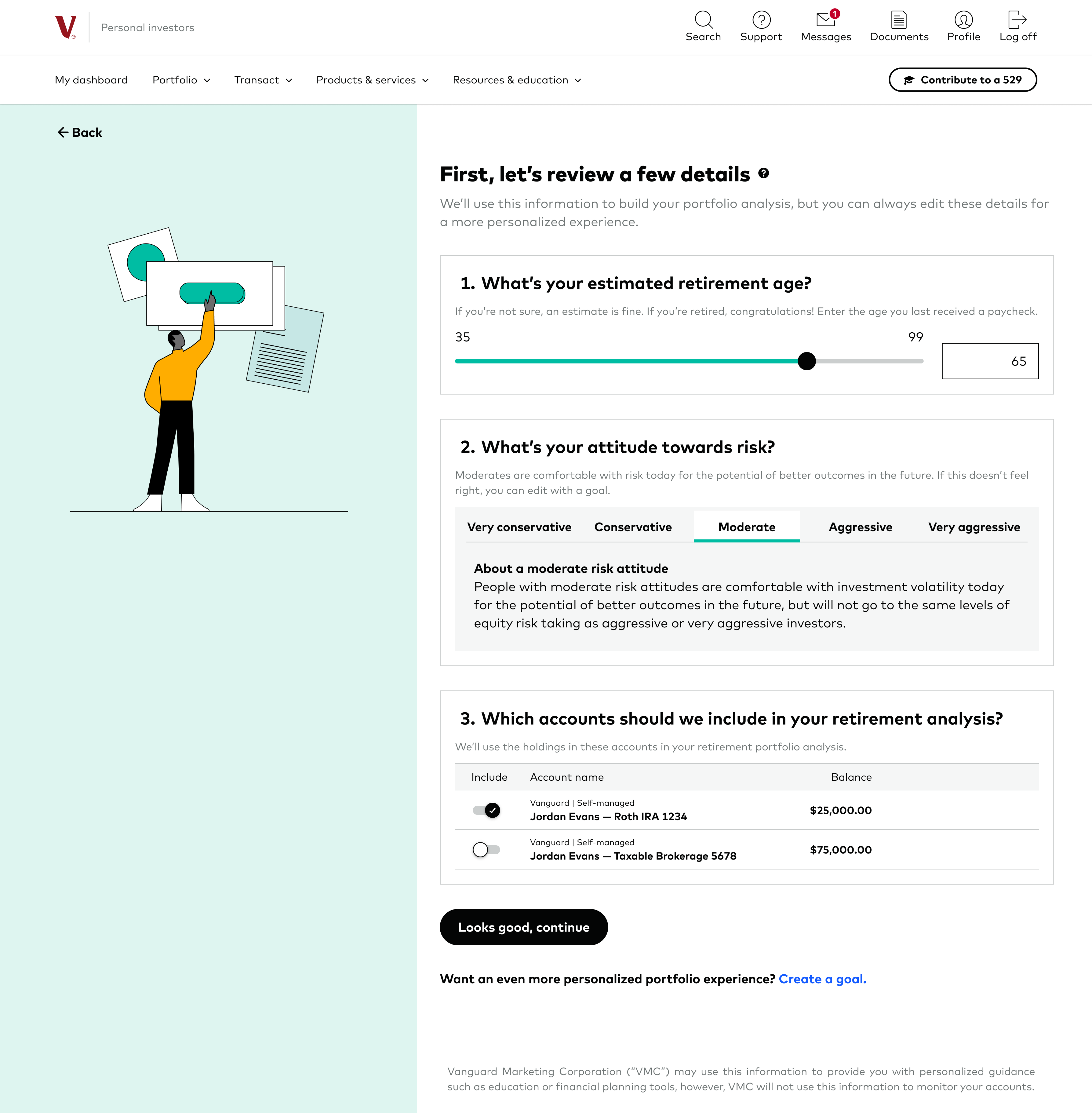

↑ Simple, default inputs

Early tests validated that users appreciate and will accept defaults, but they see the experience as more personalized, and thus more valuable, if the defaults are editable within the page.

Balancing relevance and customization against cognitive load and perceived effort continues to be a focus in iterations.

Ongoing concept testing has provided directional validation of 1-page customization improving perceived value.

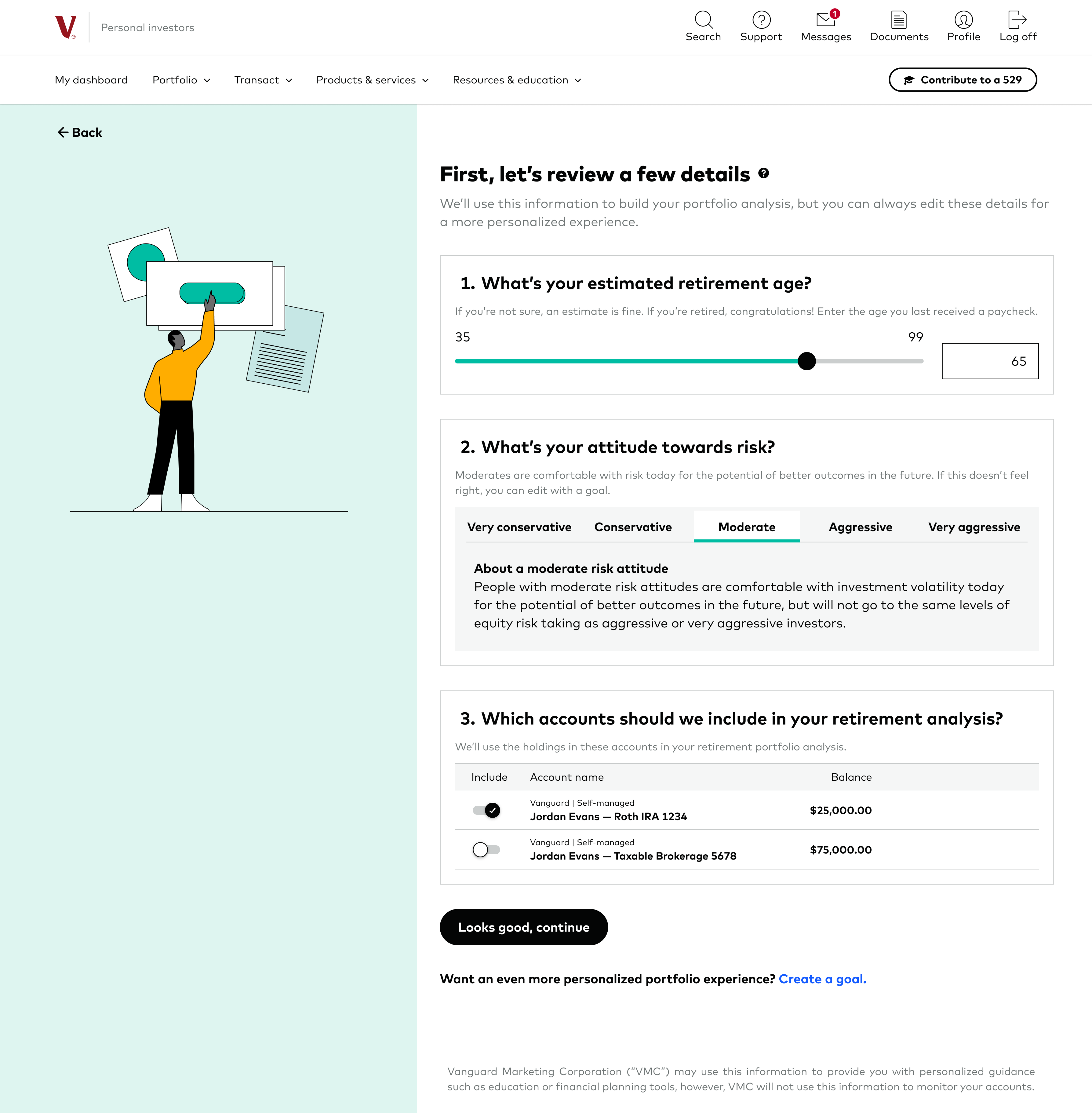

↗ Editable inputs

Balancing relevance and customization against cognitive load and perceived effort continues to be a focus in iterations.

Ongoing concept testing has provided directional validation of 1-page customization improving perceived value.

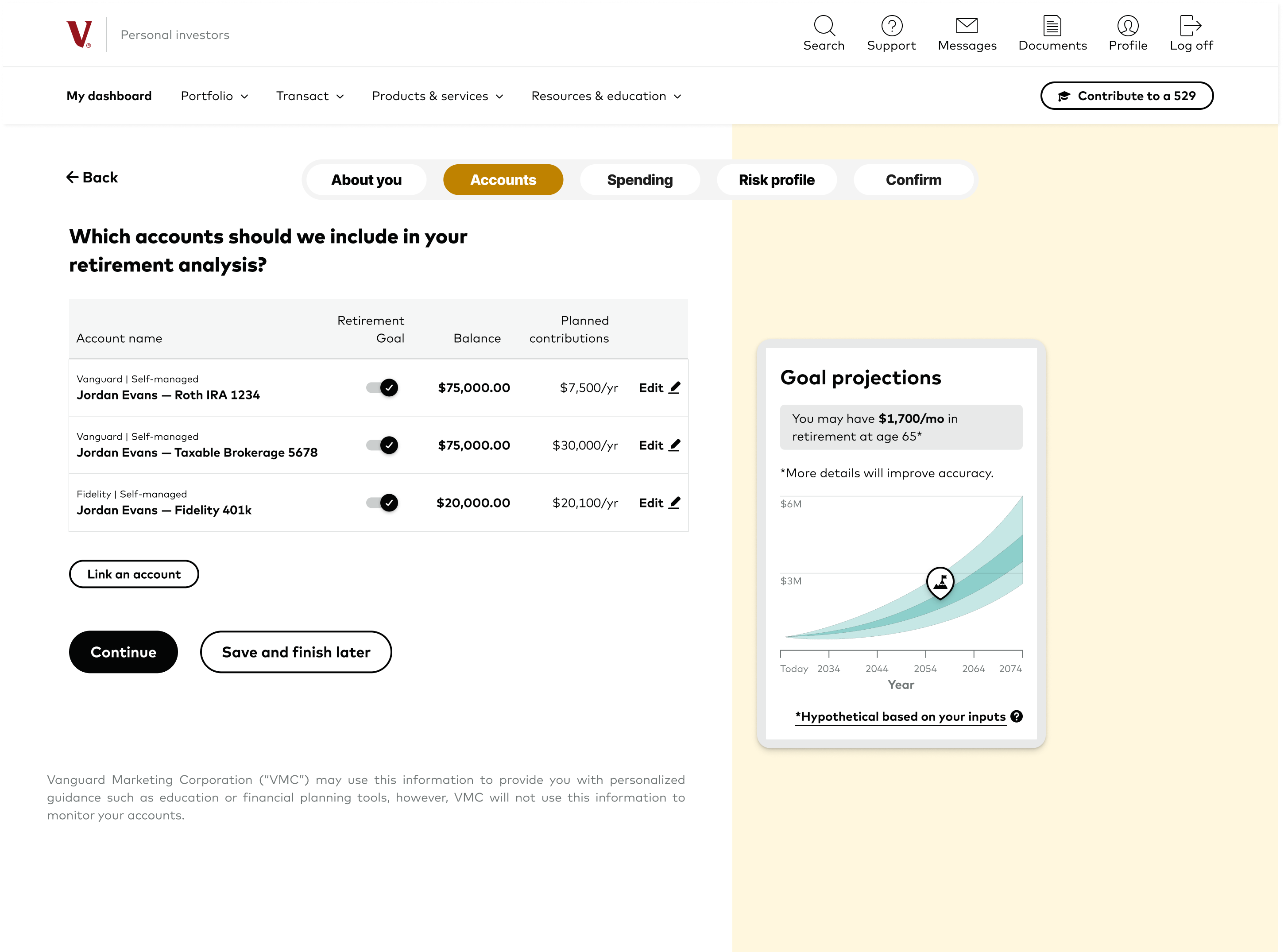

Goal setup

35%

✓About you

You may have $1,700/mo in retirement at age 65*

↑ Goal setup usability and concepting enhancements

Our team has ideated various ways to enhance the goal-setting experience and scenario play while creating a goal. We’ll test these concepts to help us define the elements that best improve ease, comprehension, perceived value, and action readiness.

June–July 2025

Next: Enhancements + Scale

We’ll continue to improve the user flow, scale impact, and sharpen differentiation to best align the product evolution to long-term strategic goals.

Janie Sanchez

About

Hi there, I’m Janie, a design strategist turning complexity into clarity for people, teams, and futures.

Currently designing at Vanguard to help make financial goals feel actionable.

Wondering about the red underline? Ask me about it in computer class.

reach out: hello@janiesanchez.com

Hi there, I’m Janie, a design strategist turning complexity into clarity for people, teams, and futures.

Currently designing at Vanguard to help make financial goals feel actionable.

Wondering about the red underline? Ask me about it in computer class.

reach out: hello@janiesanchez.com

Welcome back, Julia

$78,403.00

Value as of:

June 30, 2025, 11:40 a.m., Eastern time

Last login:

June 30, 2025, 11:40 a.m., Eastern time

Dashboard

Balances

Holdings

Activity

Performance

Goals

Portfolio watch

The ChallengePeople aspire to lead their finances with confidence, but find financial planning and investing confusing and intimidating.

My RoleAs the product designer, I mapped discovery priorities to guide user towards Vanguard’s investing principles through bite-sized, confidence-building user actions.

As the UX lead on a multidisciplinary team, I shape our product proof-of-concept and launched a pilot on track to exceed $160–426M in annual client value.

march 2024

Understanding Industry + Social Trends

Resources for self-managed portfolios range in clunky → high-risk.

april 2024

Establishing our Competitive Advantage

Vanguard is uniquely positioned to lead with integrated, goal-based experiences.

Vanguard experiences: Built on 50 years of trust

1975 | Vanguard launches the world’s 1st index fund, pioneering low-cost investing and diversification for everyday Americans 50 years ago.

2025 | Vanguard’s expertise and client trust run deep, founded in investor ownership built over millions of interactions.

Everything we know about holistic personal finance is well-documented and easily accessed, but it’s in 52-page PDF.

Everything Vanguard knows about investing, documented:

Vanguards_guide_to_financial_wellness.pdf — 52 pages

Vanguard’s investing resources: dense + comprehensive,

Let’s make them personalized + actionable.

April–June 2024

Discovery strategy

- What gaps exist between how people should invest and how they actually do?

- How can we design systems that bridge that gap—intuitively, confidently, and at scale?

Methodologyinvestment principles

Userbehavior

Participants drew their past and future savings and financial planning timelines, which revealed that financial decisions are often tied to pivotal life events.

User discovery methods

- 2 two-week diary studies (+ design missions)

- 24 user interviews

- Many feedback surveys

- 65 unmoderated tests

- 120+ days of quantitative engagement analysis

June–July 2024

User insights → features

Users’ financial mental models largely mirror Vanguard’s philosophy, but lack clarity around key areas. Our team ideated around specific synthesis areas.

“What if we sold our house? What would we do with the money? I haven't really seen a kind of a cascading scenario tool, and I would appreciate that.”

—Kristen, 29

Key user needs

Bite-sized”Help me with incrementalsteps, not everything at once”

Informative + directional”Help me choosewhat to invest in”

Exploratory”What happens when Icontribute $20 more?”

Implementable + future-proof”How do I stay on track?”

→

August 2024

Defining our pilot audience: early accumulators

Users who are just getting started investing value a simpler way to build growth, making them an ideal fit for our early pilot.

DEcember 2024

Establishing our product vision

Early concept definition focuses on a full and comprehensive goal-planning and tracking experience.

“Help me understand the nitty gritty.

Tell me everything about my retirement goal.”

Personal investors

Support

1

Log off

My dashboard

Portfolio

Transact

Products & services

Resources & education

Welcome back, Julia

$78,403.00

Value as of:

June 30, 2025, 11:40 a.m., Eastern time

Last login:

June 30, 2025, 11:40 a.m., Eastern time

Dashboard

Balances

Holdings

Activity

Performance

Goals

Portfolio watch

All Goals

Your full goals forecast

You’re projected to have $12,500 monthly in retirement.

That’s about $1,200 more than you may need. That could mean earlier retirement or more travel.

2020

2030

2040

2050

2060

2065

2070

2M

1.75M

1.25M

1M

600k

300k

0k

⛰️

Retirement fund half funded

Compound interest projected building up

⛰️

Retirement fund in use

Starting to withdraw funds ($11,300/mo)

Retirement contributions

$403,554.00

Target: $1,750,000

Funding: $1,600 monthly

✓ on track

Accounts:

- Roth IRA (4021) — $73,000.00

- Employer 401k (6395) — $205,534.00

- Brokerage (2052) — $25,020.00

Edit goal

Retirement diversification

! off track

Less

diversified

Asset mix

! off track

Global stock exposure

✓ on track

Single-stock concentration

✓ on track

Review your mix of investments

Based on your targets, your investment allocation could be more optimized.

Review portfolio ->

Your action plan

Set up your retirement goal

- Diversify your portfolio

Your portfolio does not reflect your current risk profile: 90% stocks, 10% bonds.

Review your mix of investments

Based on your targets, your investment allocation could be more optimized.

Review portfolio analysis →

- Contribute to your plan

There are some optimization actions you could take.

Set up automatic contributions

Set up your account to automatically make contributions and keep your goal on track.

Set up contributions →

4 more actions

Your activity

June 12, 2025

You hit a 12-month contribution streak! Nice work.

April 12, 2025

You increased your contributions by $250.

April 12, 2025

You made your first transfer.

8 more actions

Action list

Mitigate decision paralysis.

Diversification status

Signals the need to rebalance portfolio.

Numerical projection

Give a tangible ballpark of retirement cashflow and milestone timeline.

Contribution status

List contribution and goal details.

Activity log

Celebrate momentum.

“Help me understand the full picture.

Tell me about all my goals together.”

January–April 2025

Pilot + Learning

Yes!

We saw increased confidence and clarity in decision-making, validating our hypothesis around perceived value in scenario modeling and behavioral nudges.

But, let’s make it better.

Users continue to disengage with a goals experience if it feelstoo complex or time-intensive without a clear perceived benefit.

Goal setup

35%

✓About you

Portfolio income

Other

Projected gap

You may have $1,700/mo in retirement at age 65*

June–July 2025

Next: Enhancements + Scale

We’ll continue to improve the user flow, scale impact, and sharpen differentiation to best align the product evolution to long-term strategic goals.

Janie Sanchez

About

Hi there, I’m Janie, a design strategist turning complexity into clarity for people, teams, and futures.

Currently designing at Vanguard to help make financial goals feel actionable.

Wondering about the red underline? Ask me about it in computer class.

reach out: hello@janiesanchez.com

Hi there, I’m Janie, a design strategist turning complexity into clarity for people, teams, and futures.

Currently designing at Vanguard to help make financial goals feel actionable.

Wondering about the red underline? Ask me about it in computer class.

reach out: hello@janiesanchez.com

Personal investors

Support

1

Log off

My dashboard

Portfolio

Transact

Products & services

Resources & education

Contribute to a 529

Welcome back, Julia

$78,403.00

Value as of:

June 30, 2025, 11:40 a.m., Eastern time

Last login:

June 30, 2025, 11:40 a.m., Eastern time

Dashboard

Balances

Holdings

Activity

Performance

Goals

Portfolio watch

Your full goals forecast

1 year

5 years

10 years

Lifetime

2020

2025

2030

2035

2040

2045

2050

2055

2060

2065

2M

1.75M

1.25M

1M

600k

300k

0k

💰

Emergency fund reached

Growing at 3.7% interest

✏️

! Off track

Alex’s education target is off track

Align your contributions to meet this goal

⛰️

Retirement fund half-funded

Compound interest projected building up

⛰️

Retirement fund in use

Starting to withdraw funds at 6%

Display:

All goals

⛰️

Retirement

💰

Emergency fund

✏️

Alex’s education fund

🏡

Mortgage payoff

The ChallengePeople aspire to lead their finances with confidence, but find financial planning and investing confusing and intimidating.

My RoleAs the product designer, I mapped discovery priorities to guide user towards Vanguard’s investing principles through bite-sized, confidence-building user actions.

As the UX lead on a multidisciplinary team, I shape our product proof-of-concept and launched a pilot on track to exceed $160–426M in annual client value.

march 2024

Understanding Industry + Social Trends

Resources for self-managed portfolios range in clunky → high-risk.

april 2024

Establishing our Competitive Advantage

Vanguard is uniquely positioned to lead with integrated, goal-based experiences.

Vanguard experiences: Built on 50 years of trust

1975 | Vanguard launches the world’s 1st index fund, pioneering low-cost investing and diversification for everyday Americans 50 years ago.

2025 | Vanguard’s expertise and client trust run deep, founded in investor ownership built over millions of interactions.

Everything we know about holistic personal finance is well-documented and easily accessed, but it’s in 52-page PDF.

Everything Vanguard knows about investing, documented:

Vanguards_guide_to_financial_wellness.pdf — 52 pages

Vanguard’s investing resources: dense + comprehensive,

Let’s make them personalized + actionable.

April–June 2024

Discovery strategy

- What gaps exist between how people should invest and how they actually do?

- How can we design systems that bridge that gap—intuitively, confidently, and at scale?

Methodologyinvestment principles

Userbehavior

Participants drew their past and future savings and financial planning timelines, which revealed that financial decisions are often tied to pivotal life events.

User discovery methods

- 2 two-week diary studies (+ design missions)

- 24 user interviews

- Many feedback surveys

- 65 unmoderated tests

- 120+ days of quantitative engagement analysis

June–July 2024

User insights → features

Users’ financial mental models largely mirror Vanguard’s philosophy, but lack clarity around key areas. Our team ideated around specific synthesis areas.

“What if we sold our house? What would we do with the money? I haven't really seen a kind of a cascading scenario tool, and I would appreciate that.”

—Kristen, 29

Experience theme

Bite-sized”Help me with incremental steps, not everything at once”

Informative + directional”Help me choosewhat to invest in”

Exploratory”What happens if I contribute $20 more monthly?”

Implementable + future-proof”How do I stay on track?”

→

August 2024

Defining our pilot audience: early accumulators

Users who are just getting started investing value a simpler way to build growth, making them an ideal fit for our early pilot.

DEcember 2024

Establishing our product vision

Early concept definition focuses on a full and comprehensive goal-planning and tracking experience.

“Help me understand the nitty gritty.

Tell me everything about my retirement goal.”

Personal investors

Support

1

Log off

My dashboard

Portfolio

Transact

Products & services

Resources & education

Contribute to a 529

Welcome back, Julia

$78,403.00

Value as of:

June 30, 2025, 11:40 a.m., Eastern time

Last login:

June 30, 2025, 11:40 a.m., Eastern time

Dashboard

Balances

Holdings

Activity

Performance

Goals

Portfolio watch

All Goals

Your full goals forecast

You’re projected to have $12,500 monthly in retirement.

That’s about $1,200 more than you may need. That could mean earlier retirement or more travel.

2020

2030

2040

2050

2060

2065

2070

2M

1.75M

1.25M

1M

600k

300k

0k

⛰️

Retirement fund half funded

Compound interest projected building up

⛰️

Retirement fund in use

Starting to withdraw funds ($11,300/mo)

Retirement contributions

$403,554.00

Target: $1,750,000

Funding: $1,600 monthly

✓ on track

Accounts:

- Roth IRA (4021) — $73,000.00

- Employer 401k (6395) — $205,534.00

- Brokerage (2052) — $25,020.00

Edit goal

Retirement diversification

! off track

Less

diversified

Asset mix

! off track

Global stock exposure

✓ on track

Single-stock concentration

✓ on track

Review your mix of investments

Based on your targets, your investment allocation could be more optimized.

Review portfolio →

Your action plan

Set up your retirement goal

- Diversify your portfolio

Your portfolio does not reflect your current risk profile: 90% stocks, 10% bonds.

Review your mix of investments

Based on your targets, your investment allocation could be more optimized.

Review portfolio analysis →

- Contribute to your plan

There are some optimization actions you could take.

Set up automatic contributions

Set up your account to automatically make contributions and keep your goal on track.

Set up contributions →

4 more actions

Your activity

June 12, 2025

You hit a 12-month contribution streak! Nice work.

April 12, 2025

You increased your contributions by $250.

April 12, 2025

You made your first transfer.

8 more actions

Action list

Mitigate decision paralysis.

Diversification status

Signals the need to rebalance portfolio.

Numerical projection

Give a tangible ballpark of retirement cashflow

Milestone projection

Make goals feel closer and more achievable.

Contribution status

List contribution and goal details.

Activity log

Celebrate momentum.

“Help me understand the full picture.

Tell me about all my goals together.”

January–April 2025

Pilot + Learning

Yes!

We saw increased confidence and clarity in decision-making, validating our hypothesis around perceived value in scenario modeling and behavioral nudges.

But, let’s make it better.

Users continue to disengage with a goals experience if it feelstoo complex or time-intensive without a clear perceived benefit.

↑ Simple, default inputs

Early tests validated that users appreciate and will accept defaults, but they see the experience as more personalized, and thus more valuable, if the defaults are editable within the page.

↗ Editable inputs

Balancing relevance and customization against cognitive load and perceived effort continues to be a focus in iterations.

Ongoing concept testing has provided directional validation of 1-page customization improving perceived value.

Goal setup

35%

✓About you

Portfolio income

Other

Projected gap

You may have $1,700/mo in retirement at age 65*

June–July 2025

Next: Enhancements + Scale

We’ll continue to improve the user flow, scale impact, and sharpen differentiation to best align the product evolution to long-term strategic goals.